Unleashing Opportunities by Investing in India for Future

India remains one of the bright spots among key global economies for FDI investments due to favorable government policies, large market access, technology innovation, growing start-up eco-system, reform initiatives amongst others

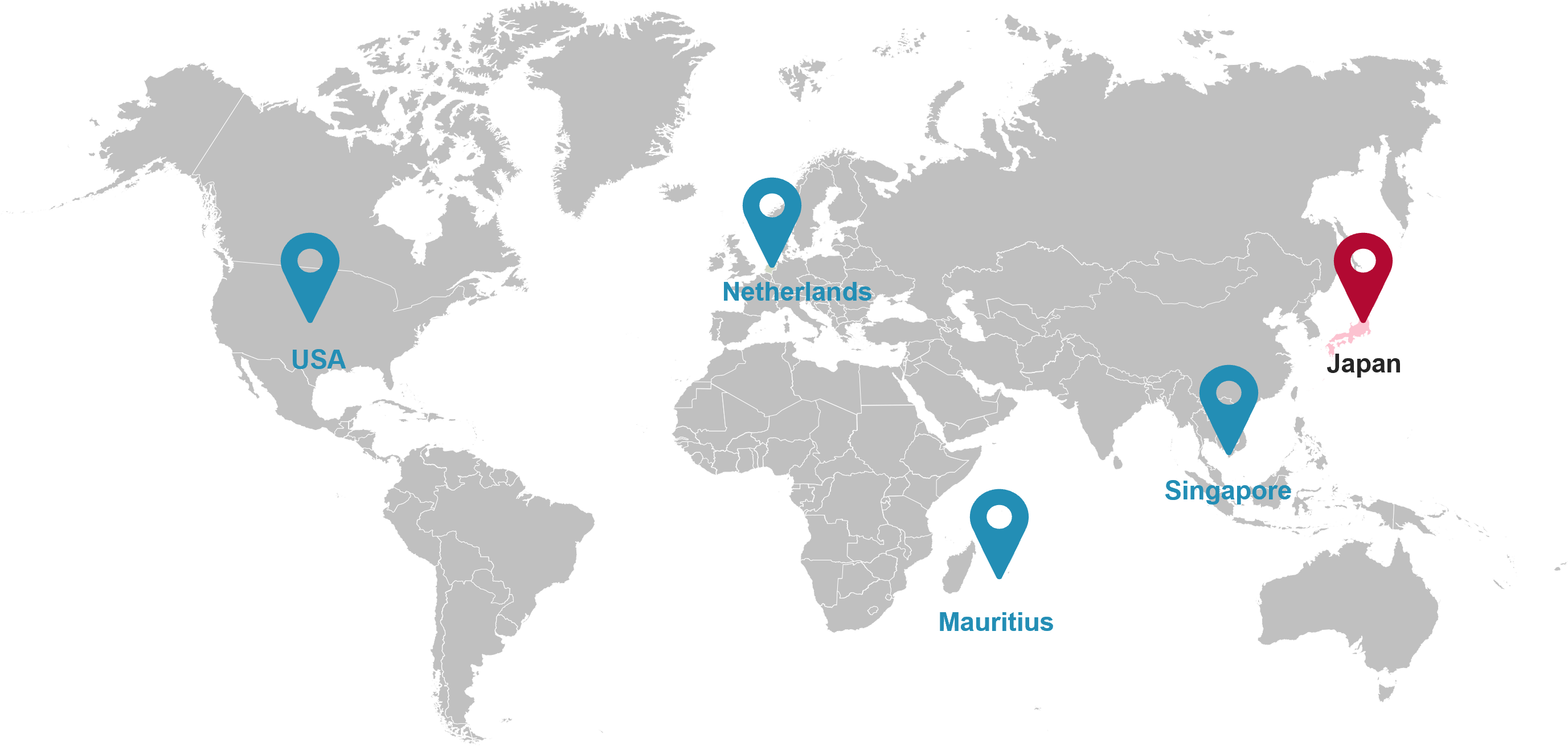

- From April 2000 to June 2023, India’s Foreign Direct Investment (FDI) Equity inflow has accumulated to a substantial USD 645 billion. Among this, Japan has significantly contributed ~USD 40 billion.

- Moreover, India's strategic preference for Japanese investors is underpinned by a combination of strategic, economic, and cultural factors, cementing Japan's role as a significant partner in India's trajectory of growth and development.

- Moreover, India and Japan hold prominent positions in Asian trade and investment. The two nations have proactively responded to mitigate the adverse effects stemming from ongoing geopolitical trade tensions, the pandemic, and its aftermath.

- Sectors that have attracted highest FDI Equity Inflow during April 2000 and June 2023 include services (16%), computer hardware and software (15%), construction (10%), telecom (6%), trading (6%), and automotive (5%).

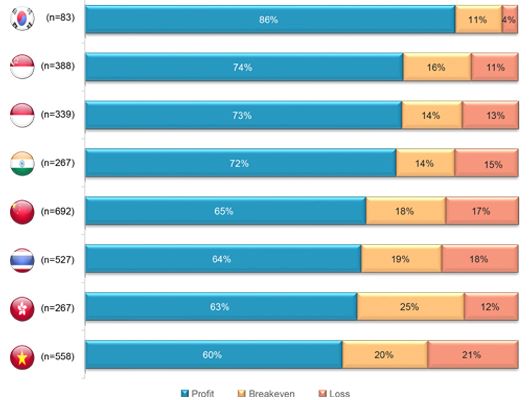

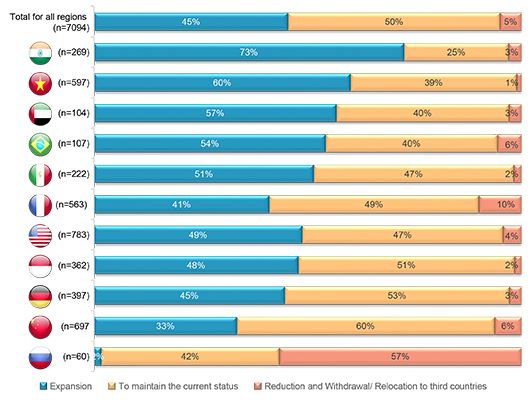

India being a priority on Japan’s Investment Radar can be attributed to its perception as a highly profitable destination for Japanese businesses. Furthermore, it is driven by the prospect of Japanese corporations in India experiencing growth and actively considering business expansion in the near term

- In the year 2022, more than 72% of Japanese companies operating in India reported a surplus. This places India among the top five most profitable destinations for Japanese corporations in the international market.

- More than 70% Japanese companies in India conveyed their intentions to expand their businesses in the next one or two years. This is the highest percentage compared with the other key countries under study.

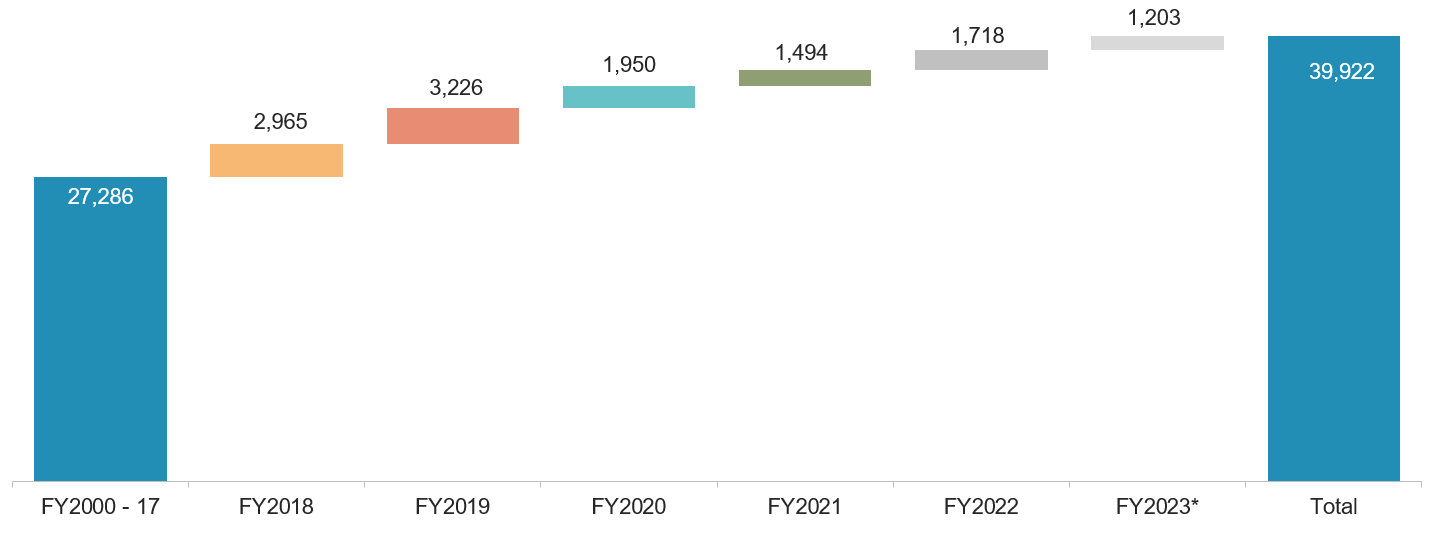

Japan have contributed over USD 39,922 billion between the years 2000 and 2023

FDI Inflow from Japan into India (USD Million)

Japan ranks fifth in terms of FDI equity inflows into India, after Mauritius, Singapore, USA and Netherlands. Japan has invested ~USD 40 billion from April 2000 to June 2023

According to the Japan External Trade Organization (JETRO), there are over 1,439 Japanese companies conducting operations in India across approximately 4,970 locations

Majority of these companies offer products and services across construction, electrical goods, transportation, industrial machine tools, chemicals, and engineering, among others who cater to the infrastructure sector.

The Japanese government also finances large infrastructure sector projects in India.

Japan ranks fifth in terms of FDI equity inflows into India, after Mauritius, Singapore, USA and Netherlands. Japan has invested ~USD 40 billion from April 2000 to June 2023

According to the Japan External Trade Organization (JETRO), there are over 1,439 Japanese companies conducting operations in India across approximately 4,970 locations

Majority of these companies offer products and services across construction, electrical goods, transportation, industrial machine tools, chemicals, and engineering, among others who cater to the infrastructure sector.

The Japanese government also finances large infrastructure sector projects in India.

Opportunity Landscape for Japanese Corporations in India

How we can help?

Global Expansion

We work with clients to help them develop a deep understanding of market dynamics, attractiveness and entry options in both emerging and developed economies

Market Entry and Go-To-Market Strategy

We work with clients to evaluate entry options (green-field, acquisitions, JV or distribution agreement) and define market access plans, decision-gates and performance metrics

M&A and Transaction Support

We work with M&A teams to help them understand market dynamics by identifying companies that meet specific criteria and conducting commercial due diligence on selected targets

Adjacencies, Diversification

Product portfolio expansion, vertical integration, concentric or unrelated diversification – our experts can help list and evaluate ideas in line with strategic objectives

Market Analysis

We work with clients to help them understand demand-supply dynamics and white spaces in specific applications or end-markets, with a view to increasing revenues or market share

Competitor Analysis

We perform deep dives on competitors, covering all aspects of their operations and financials and their specific strategies in different functional areas such as manufacturing, contracting, distribution and R&D

Customer Experience Studies

We work with clients to design and execute a one-time or ongoing customer satisfaction measurement framework that provide actionable insights on key improvement areas

Customer Needs Analysis

We generate ideas for product development or can help get feedback on your company’s next innovation by talking to key customers and influencers in the market

Category & Competitor Intelligence

We answer critical questions on direct and indirect spend categories including demand-supply dynamics, sourcing models, negotiation levers, key suppliers, peer comparison and procurement best practices

Supplier Identification & RFx Support

We help shortlist potential suppliers in emerging or developed economies based on important parameters and offer support in design and execution of RFx processes across the world

Should-cost Models

We do bottom-up analysis to estimate costs of a component, a process or service delivery – anywhere in the world to help companies negotiate better with existing and new suppliers

Supply Risk Analysis

We conduct a comprehensive mapping of the supply chain tiers to ascertain potential supply disruption risks, and also enable clients to proactively evaluate and track critical suppliers on financial and operational risk parameters

Innovation Growth & Strategy

We work with clients to develop R&D Roadmaps to achieve near and long-term innovation objectives by analyzing technology and market ecosystems, emerging trends and competitor activity

Technology Intelligence

We provide in-depth views on key problems being solved, emerging trends, competitor activity and white spaces/opportunities in a technology area or domain to help clients align their R&D efforts or identify partnership opportunities

IP Strategy

We help clients make the most out of IP assets by analyzing IP portfolios to identify monetization opportunities and develop defensive strategies to mitigate threats

Open Innovation

We work with clients to identify innovations that provide growth momentum or address gaps in the portfolio through a comprehensive scouting of technology, start-up and research ecosystem

Global Expansion

We work with clients to help them develop a deep understanding of market dynamics, attractiveness and entry options in both emerging and developed economies

Market Entry and Go-To-Market Strategy

We work with clients to evaluate entry options (green-field, acquisitions, JV or distribution agreement) and define market access plans, decision-gates and performance metrics

M&A and Transaction Support

We work with M&A teams to help them understand market dynamics by identifying companies that meet specific criteria and conducting commercial due diligence on selected targets

Adjacencies, Diversification

Product portfolio expansion, vertical integration, concentric or unrelated diversification – our experts can help list and evaluate ideas in line with strategic objectives

Market Analysis

We work with clients to help them understand demand-supply dynamics and white spaces in specific applications or end-markets, with a view to increasing revenues or market share

Competitor Analysis

We perform deep dives on competitors, covering all aspects of their operations and financials and their specific strategies in different functional areas such as manufacturing, contracting, distribution and R&D

Customer Experience Studies

We work with clients to design and execute a one-time or ongoing customer satisfaction measurement framework that provide actionable insights on key improvement areas

Customer Needs Analysis

We generate ideas for product development or can help get feedback on your company’s next innovation by talking to key customers and influencers in the market

Category & Competitor Intelligence

We answer critical questions on direct and indirect spend categories including demand-supply dynamics, sourcing models, negotiation levers, key suppliers, peer comparison and procurement best practices

Supplier Identification & RFx Support

We help shortlist potential suppliers in emerging or developed economies based on important parameters and offer support in design and execution of RFx processes across the world

Should-cost Models

We do bottom-up analysis to estimate costs of a component, a process or service delivery – anywhere in the world to help companies negotiate better with existing and new suppliers

Supply Risk Analysis

We conduct a comprehensive mapping of the supply chain tiers to ascertain potential supply disruption risks, and also enable clients to proactively evaluate and track critical suppliers on financial and operational risk parameters

Innovation Growth & Strategy

We work with clients to develop R&D Roadmaps to achieve near and long-term innovation objectives by analyzing technology and market ecosystems, emerging trends and competitor activity

Technology Intelligence

We provide in-depth views on key problems being solved, emerging trends, competitor activity and white spaces/opportunities in a technology area or domain to help clients align their R&D efforts or identify partnership opportunities

IP Strategy

We help clients make the most out of IP assets by analyzing IP portfolios to identify monetization opportunities and develop defensive strategies to mitigate threats

Open Innovation

We work with clients to identify innovations that provide growth momentum or address gaps in the portfolio through a comprehensive scouting of technology, start-up and research ecosystem

Why Aranca as a research partner?

Centricity

Expertise

Experience

People

Techniques

Talk TO

Aranca goes to great lengths to understand the Client’s business, problems and ambition.

We collaborate with various Client stakeholders to deliver a customized solution on every engagement. We do not force-fit pre-conceived frameworks to a Client’s unique situation. A key strength is our ability and flexibility in designing tailor-made solutions that address specific client issues, perspectives and budgets.

Aranca has strong vertical practices spanning ten core sectors, and members from these practices engage with each other every day, harnessing the exponential power of our collective knowledge.

Clients can rest assured that their project will always be managed by experienced analysts who have deep knowledge of the domain or the specific product / service being researched.

Aranca has home country advantage for India-based engagements and understands the local market nuances and challenges.

Aranca has completed nearly 500 projects in India across various sectors at a pan-India level enabling Aranca to gain robust regional understanding.

Aranca has established robust on-going working relationships with its Japan-based clients

This enduring partnership is characterized by seamless communication, mutual trust, and successful collaboration, showcasing our commitment to delivering exceptional service.

We are an integrated group of diverse practitioners and a team of deep thinkers and hands-on professionals.

All our analysts and consultants are professionals with advanced engineering, technical or management degrees, and deeply passionate about research and problem-solving. This enables us to walk in our client’s shoes and treat every assignment as if it will drive choices that we would readily back with our own actions.

We focus on what matters most, that is, high-quality data and insights that drive better decisions.

We combine a rigorous project lifecycle framework, desk research, extensive on-ground market research and thousands of man hours of collective industry research experience to deliver data/facts and insights that are reliable and actionable. With analyst teams and access to industry experts across the globe, we help our clients to develop a powerful understanding of how industries operate at a regional / global level and opportunities they can leverage in different markets.

We ask the right questions. To the right professionals

Featured Case Studies: India Experience

Assessment of the Lighting Products Market in India

A Japanese electrical equipment supplier enlisted the services of Aranca to gain a comprehensive understanding of the current state and potential of lighting products in the Indian market.

The research involved in-depth qualitative discussions with 35 to 40 stakeholders spanning the entire value chain. The study aimed to ascertain the market size of lighting products, categorizing them based on applications such as residential, shopping complexes, institutions, hospitals, etc., and product types including ceiling lights, downlights, spotlights, chandelier lights, bracket lights, and standard lights.

Additionally, we delved into the distribution models used by key players, examining their supply channels to wholesalers, large retailers, supermarkets, hypermarkets, and local shops. The investigation also focused on determining market characteristics, assessing whether the market was fragmented or consolidated, and identifying whether it was predominantly led by local players or multinational corporations (MNCs).

Market study on Solar Batteries in India

A leading global energy storage solutions company, specializing in the manufacturing and supply of batteries for transportation and industrial applications, collaborated with Aranca to acquire in-depth knowledge about the solar batteries market in India.

Subsequently, this collaboration aided in formulating a go-to-market strategy for entering this market. The research process comprised more than 75 telephone interviews with various industry stakeholders, including OEMs, system integrators, end-user segments, and global suppliers.

Opportunity Assessment for Construction Engineering Market in India

A Japanese engineering consultancy firm engaged with Aranca to explore opportunities in the Indian construction industry, aiming to partner with Indian firms for projects spanning infrastructure, industrial, commercial, and residential real estate.

The engagement involved an in-depth analysis of market structures in these segments, identification of key players, profiling the top 40 engineering service providers, and addressing primary risks and challenges affecting the engineering and MEP service market in India.

Market Study on Recycled Construction Aggregates in India

A construction aggregate manufacturer based in Japan and supplying recycled construction aggregates (derived from construction waste) sought Aranca’s support to assess the Indian market for construction aggregates and Ready-Mix Concrete (RMC) and the market potential for recycled aggregates.

We evaluated the present and anticipated RMC market size, comprehending demand–supply dynamics, examining construction waste disposal methods and regulations, appraising the market demand for recycled aggregates, scrutinizing supply-side conditions, and assessing the competitive landscape in India's construction aggregates industry.

Competition Benchmarking In FMCG Sector for Formulating Entry Strategy In Rural Indian Market

A leading FMCG company collaborated with Aranca to enhance manufacturing and distribution efficiency, reducing costs.

Aranca conducted extensive global research, comprising 100+ face-to-face and 90+ telephonic interviews, to identify and analyze innovative business models of companies established in emerging economic markets.

The outcome involved shortlisting 5–6 successful models, each detailed through case studies showcasing business model evolution, manufacturing scale-up, and strategic initiatives for cost reduction.

Market study and target identification – “Heavy-duty motorized machinery” sector in India

A prominent multinational corporation engaged with Aranca to assess potential market entry opportunities in the heavy-duty motorized machinery sector in India.

The study involved conducting 100+ phone interviews with industry experts, encompassing a thorough analysis of the value chain, average investments at different stages, competitor segmentation based on market share and offerings, and identification of market opportunities and threats.

In addition, the study evaluated the competitive landscape to determine the most suitable business engagement, explored deal activities in the country, and formulated recommended entry strategies.

Potential target companies were identified for investment, acquisition, or joint ventures, with initial discussions initiated with these targets.

Benchmarking study for dialysis centers across select cities in India

The client aimed to identify opportunities in the dialysis center sector in select Indian cities.

The assessment involved evaluating market size, growth rates, and essential metrics, and conducting approximately 125 interviews with key personnel in dialysis centers to gain insights into market dynamics, patient preferences, and facility infrastructure.

Aranca is a global research analytics and advisory firm with over 20 years of experience in helping organizations take strategic business and investment decisions fearlessly and with utmost conviction.

© 2025, Aranca. All rights reserved.

Potential

Potential

Enablers

Enablers

Schemes

Schemes

Investment Scenario

Investment Scenario