Write to Us

FAQs

- What is a 409A valuation?

- Who needs a 409A valuation?

- Can I not consider my last funding price?

- What is the risk of not doing a 409A valuation?

- Can I consider getting a 409A valuation from online tools or my cap table provider?

- Would it be efficient to perform a 409A valuation from my cap table management vendor?

- Can I perform the 409A valuation in-house?

- How often do I need to perform a 409A valuation?

- What makes the 409A valuation from Aranca unique?

- What is safe harbor? Does Aranca comply with it?

- The founders are getting partial liquidity in the next funding round. Will that impact my 409A price?

- What is Aranca’s process?

- What data would be required to complete a 409A valuation?

- What does a 409A valuation report cover?

General

The IRC 409A regulation of the IRS mandates that you cannot issue stock options below the Fair Market Value. Furthermore, such Fair Market Value should ideally be determined by an independent third party.

So, a 409A valuation is an independent third-party valuation of the common stock of your company, which is required to issue stock options to employees.

Any company that is issuing stock options requires a 409A valuation. This is typically done when a company is putting together a stock option plan, usually after a new funding round.

Can I not consider my last funding price

The funding is typically raised by issuing preferred shares that have superior rights (liquidation preference, participation, etc.) than shares of a minority common shareholder. Hence, the funding price is much higher than what a 409A valuation would conclude, and by using the funding price, the company would make the option price non-lucrative for the employees.

Therefore, it is advisable to get a separate 409A valuation, which would ensure compliance for the company and appropriately reflect the business risk from the viewpoint of minority common shareholders.

What is the risk of not doing a 409A valuation

There is a twofold risk of not carrying out a 409A valuation.

- Firstly, you may end up being non-compliant with IRC section 409A. This would result in adverse tax consequences for the option recipient, where the gain would be subject to taxation at vesting rather than exercise. Moreover, there would be additional penalties and interest charges to the company.

- Secondly, many companies feel that given the historical trends, the risk mentioned above is very minimal. However, you have to keep in mind that even if that is true, 409A compliance is part of a due diligence checklist of every investor and acquirer. Hence, if you have not done any 409A valuation, you may escape from the IRS consequences, but your investment or M&A process will get derailed because of non-compliance. In addition, while you may be willing to take this risk, a potential investor would not want any exposure and would expect compliance.

Can I consider getting a 409A valuation from online tools or my cap table provider

Most online tools produce automated boiler plate reports with 0–8 hours of an expert’s efforts. The minimum time required to do a credible job is at least 30–40 hours. Now even if these reports satisfy the compliance checklist, they have two key practical drawbacks:

- Since these tools use automated statistical models, they often overvalue common stock by almost 30–50%, which is a big demotivation for employees and defeats the whole purpose of having an option plan in the first place.

- The automated online tools are mostly rejected by audit firms. While it may not seem to be a risk for early-stage companies that are not being audited, the due diligence audit teams of investors/acquirers review reports since the company’s inception, and a short-sighted move early on often derails or delays the funding or acquisition deal.

Would it be efficient to perform a 409A valuation from my cap table management vendor

The cap table only forms 10% of the input for a 409A analysis. A core part of the analysis involves understanding the business model and funding structure, and evaluating comparable companies to drive the valuation. Thus, the efficiencies gained from leveraging the cap table are not considerable.

Can I perform the 409A valuation in-house

Although you can perform the 409A valuation in-house, the onus to prove that the stock options are not undervalued lies on you.

However, an assessment by an independent AICPA-certified appraiser would transfer the onus of proof on the IRS. The risks of non-compliance are higher, which is not worth the management’s time and effort.

How often do I need to perform a 409A valuation

A 409A valuation report is valid up to 12 months from the valuation date or the date of any significant event that can impact the report materially (whichever is earlier).

What makes the 409A valuation from Aranca unique

Aranca’s positioning is highly unique because it is one of the few firms that truly resolve the conflict between price and quality (risk exposure). Our 409A pricing starts from just $1,299, and our industry analysts spend a minimum of 40 hours on each valuation to ensure it is compliant with the highest standards of review, including by the Big 4s, IRS, and SEC.

We have an impeccable audit track record offer of free lifetime audit review support at no additional cost.

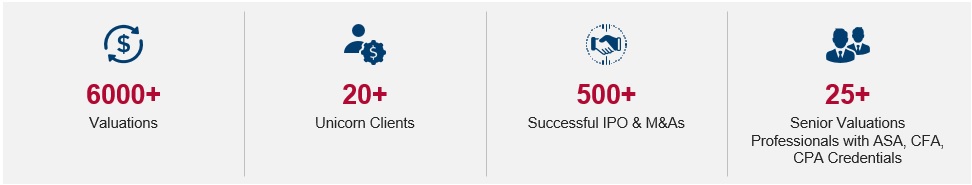

Aranca is one of the older firms carrying out 409A valuations since its inception in 2005. Here are some statistics highlighting our experience.

What is safe harbor? Does Aranca comply with it

Simply put, if a safe harbor method is employed to value stock options, the IRS must prove that the company was grossly unreasonable in determining the Fair Market Value of the security before it can claim any penalty from the subject company. A 409A valuation from Aranca provides you a safe harbor.

Peculiar Situations

The founders are getting partial liquidity in the next funding round. Will that impact my 409A price

Please refer to our blog on the following link to get insights on how such transactions affect 409A valuation: https://www.aranca.com/knowledge-library/blogs-and-opinions/investment-research/founders-stock-sale-how-not-to-turn-it-into-a-409a-nightmare

Process & Timeline

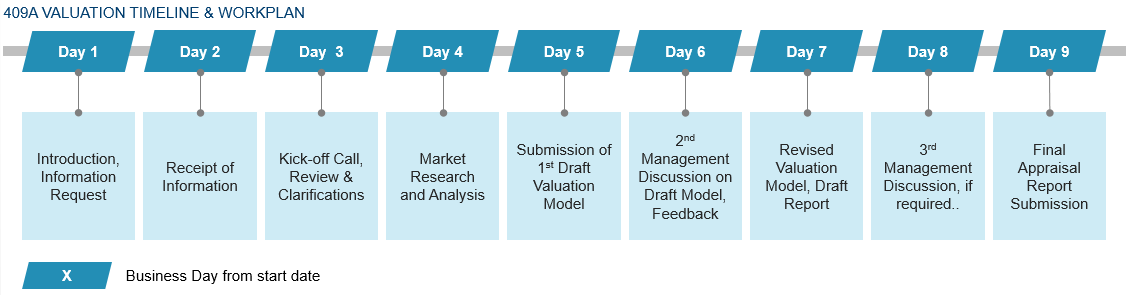

A typical 409A valuation requires 7–10 business days depending on the complexity and information available.

What data would be required to complete a 409A valuation

Here is the key information required to perform a 409A valuation.

- Capitalization table of the company

- Certificate of incorporation

- Historical and forecast financial statements, along with the business plan (if available)

- Information on recent transactions and stock purchase agreement with the term sheet (if any)

What does a 409A valuation report cover

Our 409A reports are detailed to meet the needs of the auditors, investors, and IRS.

A typical report would provide an overview of the engagement, company, industry, economy, valuation analysis, and allocation of the equity value to different classes of shareholders. You can download a sample report here.

For further details please contact:

Manish Goyal, CFA

Director | Valuation Advisory Services, Aranca 2100 Geng Rd, Suite 210 PALO ALTO, CA 94303 E: Manish.goyal@aranca.com M – (408) 310-2435

- What is a 409A valuation?

- Who needs a 409A valuation?

- Can I not consider my last funding price?

- What is the risk of not doing a 409A valuation?

- Can I consider getting a 409A valuation from online tools or my cap table provider?

- Would it be efficient to perform a 409A valuation from my cap table management vendor?

- Can I perform the 409A valuation in-house?

- How often do I need to perform a 409A valuation?

- What makes the 409A valuation from Aranca unique?

- What is safe harbor? Does Aranca comply with it?

- The founders are getting partial liquidity in the next funding round. Will that impact my 409A price?

- What is Aranca’s process?

- What data would be required to complete a 409A valuation?

- What does a 409A valuation report cover?

Aranca is a global research analytics and advisory firm with over 20 years of experience in helping organizations take strategic business and investment decisions fearlessly and with utmost conviction.

© , Aranca. All rights reserved.