Will ESG become the new norm for selecting investments?

Published on 10 Jan, 2020

The phrase Environmental, Social and Governance (ESG) Investing, often used interchangeably with socially responsible, sustainable, and mission-related investing, was coined at the Who Cares Wins Conference in 2005. The conference was attended by asset managers, institutional investors, global consultants, research analysts, and government bodies and regulators to discuss the importance of ESG in longer-term investments as well as financial research.

Besides its corporate goal, every company has an obligation toward the society. ESG, or Environmental, Social, and Governance, are the three critical parameters to measure the societal impact of investment in a company. These criteria influence the future financial performance of companies. Under ESG investment ranking, a set of standards are applied to evaluate a company’s operations and provide ratings on that basis. Investors use these ratings to identify and screen their investments and take decisions on whether or not they should invest in an enterprise.

Market for ESG funds in nascent stage but gaining traction rapidly

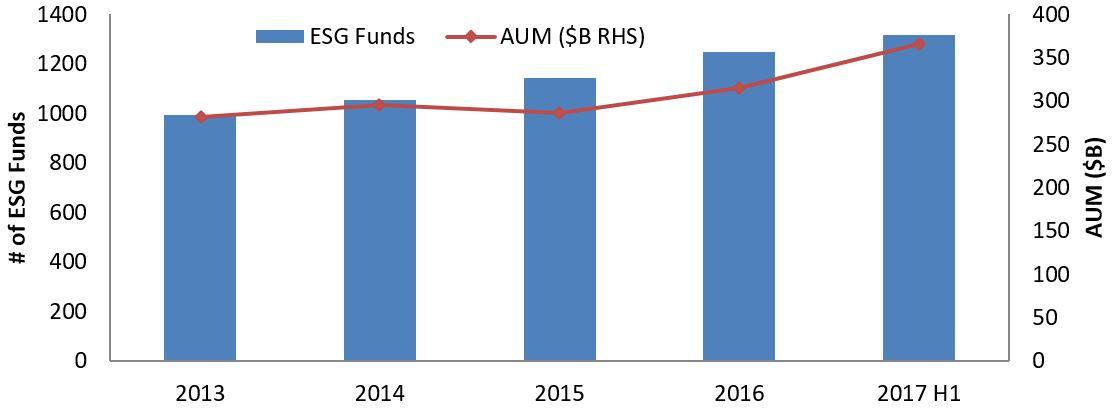

A Bloomberg Intelligence study shows that ESG assets grew by 37% in 2017, outpacing other assets under the MSCI World Index. Number of funds created for these nearly doubled in 2016 vis-à-vis 2013, the highest being in 2017. Despite the growth, there is scope for the ESG niche market to grow further.

Initially, institutional investors were wary of the ESG investing concept, and argued that their main objective was to maximize shareholder value regardless of the ESG impact. However, lately, the financial implications of ESG have come to light. ESG integration is increasingly identified as a part of fiduciary duty in markets such as the US and EU. Today, investors are factoring in risks not considered earlier, such as climate change, rising temperatures, floods, rise in sea level, privacy theft, data security, demographic shifts, and regulatory pressures. With companies increasingly getting exposed to risks, modern investors are revaluating their approach to investment.

ESG is evolving and occupying the center stage for asset management firms and institutional investors. ESG assets and funds have grown since 2015 amid rise in demand for such strategies.

ESG Funds and Assets Under Management (AUM)

Gaining traction

Equity ESG funds have grown at a faster pace than other sub-categories.

Positive impact of ESG investing on operations

Confidence in incorporating ESG investment and risk-adjusted returns is increasing. Factors motivating investors to invest in ESG funds include improved long-term returns, better reputation and lower investment risk.

The key question is does incorporating ESG activities help a company to improve its performance and, thereby, benefit shareholders. The answer lies in the fact that having an ESG profile reduces a company’s exposure to political, regulatory or reputational risks and lowers volatility in cash flows and profitability. Studies and ESG models show that companies ranking high on ESG parameters are more likely to have consistently lower future stock price volatility and higher average returns on total equity compared to those with low ranking.

Performance of top ESG rated companies

Company |

ESG Rating |

1-year Returns |

3-year Returns |

5-year Returns |

|---|---|---|---|---|

Edwards Lifesciences |

AA |

55.75% |

138.62% |

264.71% |

Equinix |

AA |

65.38% |

57.93% |

166.65% |

Prologis |

AA |

54.12% |

65.20% |

105.26% |

Emcor Group |

AA |

44.77% |

23.87% |

106.01% |

Cadence Design Systems |

AA |

62.78% |

174.54% |

293.18% |

National Research |

AA |

75.42% |

244.33% |

410.70% |

NextEra Energy |

AAA |

39.29% |

102.55% |

126.78% |

Microsoft |

AAA |

55.62% |

152.42% |

247.47% |

Hasbro |

AA |

30.03% |

26.76% |

93.07% |

Owens Corning |

AA |

47.34% |

23.80% |

79.00% |

MSCI World ESG Leaders |

16.06% |

13.07% |

8.36% |

ESG issues can directly or indirectly impact a company’s profits and returns. Companies with higher valuations would be in a better position to invest in measures that improve their ESG profile, which in turn improves the ESG scores.

- Dow Chemicals reported savings of USD 9.4 billion through energy efficiency improvements over a period of 16 years.

- Recycling and reuse initiatives saved General Motors over USD 2.5 billion.

Roadblocks in ESG market

Several models provide ESG scores for companies. The parameters considered in each may vary, just as the methodology for calculating the scores varies. Popular rating models are:

- MSCI ESG Rating: Offers a set of 200+ metrics for evaluation of funds on ESG risks, exposure to sustainable impact themes as well as value-oriented issues

- Bloomberg ESG Rating: Tracks approximately 800 different metrics that cover all aspects of ESG

- Sustainalytics: Covers close to 40 industry-specific indicators for ESG ratings

- Refinitiv: Covers over 70% of global market cap and more than 400 different ESG metrics

Each of these models may suffer from data discrepancies (for a company) due to lack of consistent reporting standards for ESG data. Companies in the same sector may report different data points. Furthermore, the same company could report different data points year-on-year. Investors are, therefore, spending huge funds toward the standardization and interpretation of unstructured data.

Another challenge is that third-party generated scores reflect not only a company’s reported data, but also the view of the analyst generating the score. This is essentially the reason why scores can be differing for different ESG rating platforms. The solution to the inconsistency in ratings is that investment management firms should assign their own scores to public companies. These firms can use the ESG data reported by companies and weigh factors based on their values and beliefs.

Consistent reporting framework a key requirement for ESG data

ESG reporting is likely to become increasingly common across all industries, as investors continue to demand transparency and accountability from industry participants Growth in the industry depends on the ability to develop or agree on a standard data reporting framework