100% FDI in Insurance: Lessons from China and Brazil for India’s Growth

Published on 18 Mar, 2025

Foreign Direct Investment (FDI) has been instrumental in fostering economic growth across several countries. Markets that have embraced foreign investment have benefited from increased capital inflows, technological progress, job creation, and enhanced industry standards. A notable example is China, which transformed into a global manufacturing hub as foreign companies drove rapid economic and industrial expansion following market deregulation in the late 20th century. Similarly, Brazil experienced significant economic and financial sector growth, supported by stronger regulatory frameworks and initiatives promoting financial inclusion.

India Allows 100% FDI in Insurance Sector

The decision to permit 100% FDI in India’s insurance sector marks a pivotal shift for the industry. As the world's most populous nation with insurance penetration still trailing the global average, the country offers a significant growth opportunity for both domestic and international insurers. Opening the sector to foreign investment could attract substantial capital, drive innovation, and introduce global best practices — factors that could transform the market and expand coverage to millions of underserved consumers.

Historically, countries such as China and Brazil have undertaken similar liberalization efforts, allowing foreign players into their insurance markets with varied results. While foreign insurers initially faced challenges in capturing substantial market share, increased competition ultimately led to greater consumer choice, enhanced service standards, and accelerated technological advancements.

Analyzing the performance of China and Brazil post-liberalization provides valuable insights into the potential impact of foreign insurers, brokers, claims management firms, and other key stakeholders entering India's insurance landscape. Each country’s experience underscores distinct factors that influenced the evolution of their insurance industry. The following case studies explore these developments and highlight critical lessons for Indian insurers and policymakers navigating this transformation.

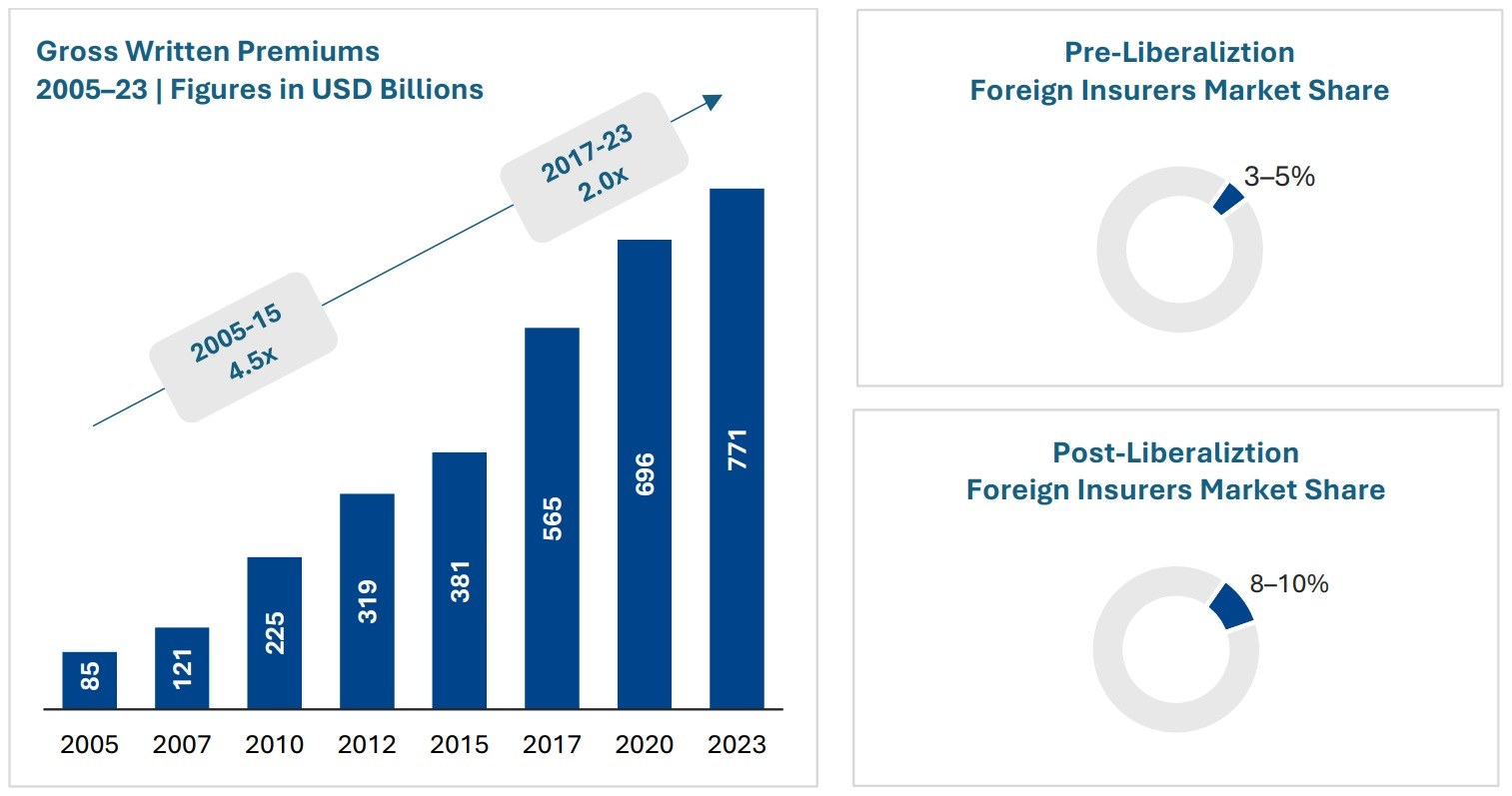

China

China’s insurance sector has undergone a remarkable transformation, evolving from a tightly controlled industry to an increasingly open and dynamic market. The journey began in 1992, when China first allowed foreign insurers to enter the market, with American International Group (AIG) becoming the trailblazer as the first foreign company to receive a license. This laid the foundation for broader reforms, but it was just the beginning of a decades-long process of gradual liberalization.

Momentum picked up after China’s accession to the World Trade Organization (WTO) in 2001, when the country committed to progressively opening its insurance market. Foreign insurers gained the ability to offer life, health, and pension products, with their operations slowly expanding across more regions. Yet, these players initially captured only a small portion of the market, as ownership restrictions and regulatory complexities limited their growth.

By 2015, China introduced significant reforms to modernize the market, including the implementation of the China Risk-Oriented Solvency System (C-ROSS), which aligned the country’s solvency standards with international best practices. This change not only bolstered market stability but also created opportunities for foreign insurers to innovate and refine their product offerings.

In 2017, signs of deeper liberalization emerged, as regulators hinted at a gradual removal of foreign ownership caps. At the same time, the government tightened oversight to curb risky market practices, creating a more disciplined environment that aligned well with the conservative, long-term strategies of many global insurers. These shifts signaled that China was preparing for a more level playing field, encouraging foreign players to start positioning themselves for greater control and influence.

The transformation reached its peak in 2020, when China officially lifted foreign ownership limits, allowing foreign companies to own 100% of their Chinese insurance ventures. This pivotal policy shift unlocked new potential for global insurers to establish a stronger foothold in one of the world’s largest and fastest-growing insurance markets. Years of steady reforms and strategic investments had culminated in an industry more connected to global markets — a testament to the long-term benefits of China’s gradual but relentless pursuit of market liberalization.

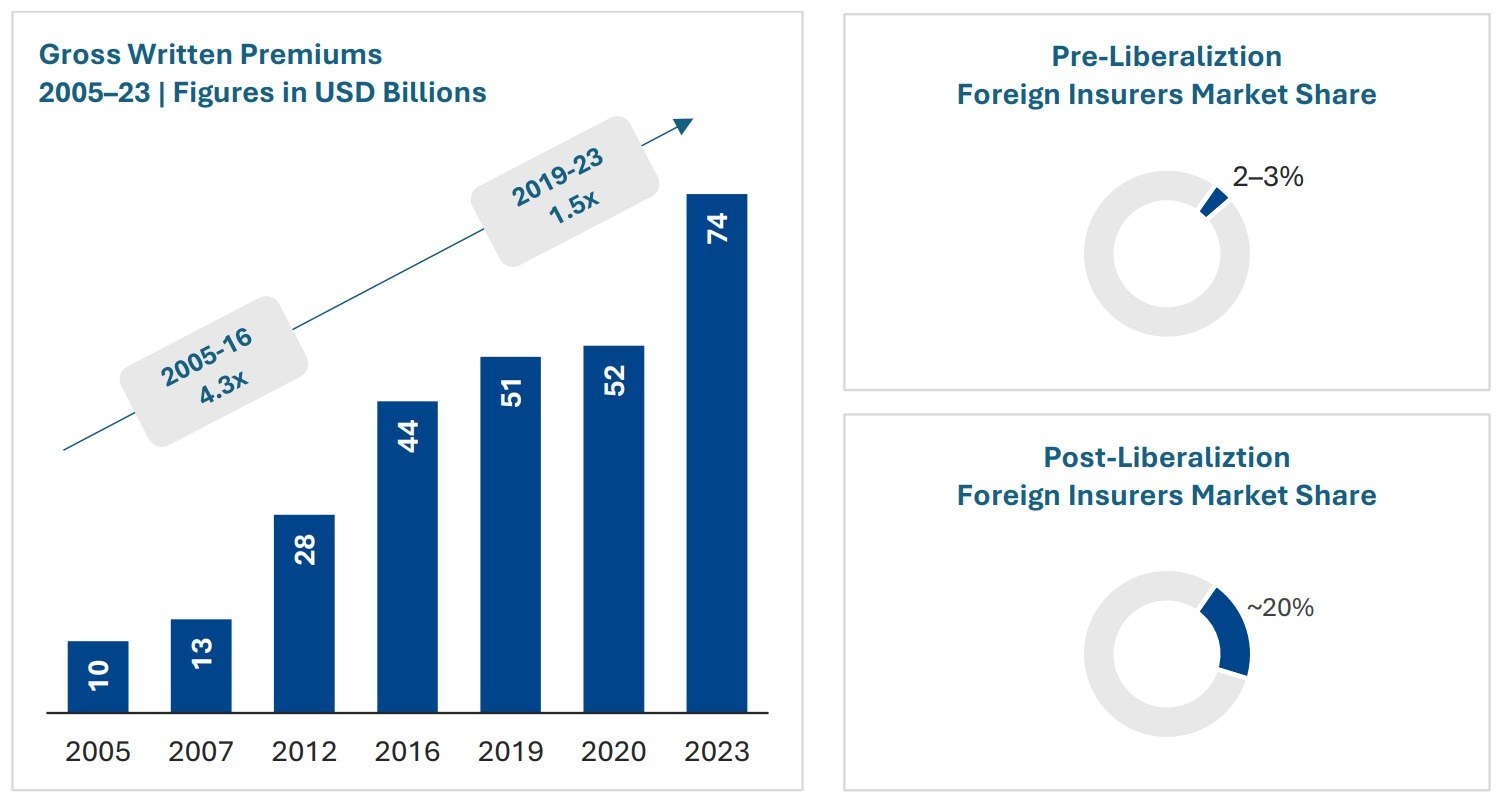

Brazil

Brazil's insurance sector has undergone substantial growth and modernization following the relaxation of foreign ownership restrictions in 2007. This pivotal reform opened the doors for global insurers to invest in the Brazilian market, bringing in much-needed capital, innovation, and international best practices. While domestic insurers continued to hold a dominant position, foreign players gained significant ground by leveraging strategic acquisitions, joint ventures, and technology-driven solutions.

Regulatory reforms also played a crucial role in strengthening Brazil’s insurance landscape. The introduction of risk-based capital frameworks and enhanced solvency regulations aligned the sector more closely with global standards, boosting investor confidence and encouraging greater foreign participation. Additionally, technological advancements driven by foreign expertise accelerated the adoption of digital insurance platforms, improving customer experience and underwriting efficiency.

Despite foreign entry, local insurers maintained their dominance, controlling a significant share of the market. However, the influx of international competition enhanced product diversity, introduced more competitive pricing models, and improved risk management practices. Over time, the collaboration between domestic and foreign insurers helped expand insurance penetration beyond major metropolitan areas, reaching previously underserved segments such as rural populations and small businesses.

Brazil’s experience demonstrates that liberalization alone does not lead to immediate foreign dominance—instead, it fosters gradual market integration, innovation, and stronger industry resilience. The country’s journey provides valuable lessons for India, particularly in balancing foreign investment with domestic industry development to create a more inclusive and competitive insurance sector.

Foreign Corporations that Entered Countries Post Liberalization

| Company Name | Home Country | International Country | Route to Entry | Year |

|---|---|---|---|---|

| Tesla, Inc. | US | China | Greenfield Investment | 2024 |

| Registered an insurance brokerage firm named Tesla Insurance Brokerage in Beijing, aiming to offer insurance products tailored for its electric vehicle customers in China | ||||

| Prudential Financial | US | China | Greenfield Investment | 2024 |

| Approved to set up an insurance asset management firm in Beijing, enhancing its presence in China's insurance sector | ||||

| Chubb | Switzerland | China | Acquisition | 2021–23 |

| Gradually increased its stake in Huatai Insurance Group, receiving final approval in December 2023 to acquire 100% ownership, making it a wholly owned subsidiary considered to be one of the largest foreign takeovers in China’s insurance sector | ||||

| Arthur J. Gallagher & Co. | US | Brazil | Acquisition | 2022 |

| Acquired Interbrok Group, a retail insurance broker headquartered in São Paulo enhancing its presence and service capabilities in the Brazilian market | ||||

| Manulife | Canada | China | Joint Venture to Full Ownership | 2022 |

| Received approval to acquire the remaining 49% stake in Manulife-Sinochem Life Insurance, becoming the first foreign life insurer to fully own a China-based joint venture post-liberalization | ||||

| Tokio Marine | Japan | China | Acquisition | 2022 |

| Completed 100% acquisition of Safety Insurance Public Company Limited, making it one of the few fully foreign-owned P&C insurers operating in China | ||||

| Allianz SE | Germany | China | Greenfield Investment | 2021 |

| Received approval from the China Banking and Insurance Regulatory Commission to establish Allianz Insurance Asset Management Co., Ltd., marking the first wholly foreign-owned insurance asset management company in China | ||||

Key Takeaways and the Road Ahead for India

As India considers the transition to 100% FDI in the insurance sector, the experiences of China and Brazil offer important lessons:

Market Expansion & Increased Coverage

- Foreign insurers entering independently can drive growth in Tier-2 and Tier-3 cities

- Rural areas can benefit from micro-insurance products designed for farmers, gig workers, and small businesses

- Example: A global insurer could introduce artificial intelligence (AI)-driven, low-premium health and crop insurance solutions, expanding financial protection for underserved populations

Technology & Product Innovation

- Increased competition could lead to lower premiums and better product offerings.

- Foreign companies bring advanced underwriting models, AI-driven claim settlements, and customer-centric digital solutions

- Example: Introduction of dynamic car insurance pricing based on real-time driving behavior, which can push domestic insurers to modernize their offerings

Industry Consolidation & Strategic Alliances

- Smaller Indian insurers may merge or be acquired by stronger global players

- Indian insurers could partner with foreign firms to gain access to international expertise and risk models

- Example: An Indian insurer joining forces with a foreign counterpart could introduce sophisticated disaster insurance products based on global best practices

Outlook

The influx of foreign capital and expertise can strengthen India's insurance industry, but success will depend on how effectively foreign participation is balanced with local market dynamics. A well-regulated framework, investment in consumer education, and strategic public-private partnerships will be essential in ensuring that this transition benefits all stakeholders—insurers, investors, and millions of Indian policyholders seeking financial security.