Global Private Equity Fundraising: Key Insights and Trends

Published on 23 Dec, 2024

PE fundraising is a key indicator of market conditions and investor sentiment, offering insights into capital flows and emerging trends. As economic and industry dynamics evolve, PE fundraising adapts to reflect shifts in investor priorities, risk appetites, and sectoral focus. This edition of the PE Fundraising Report examines the 2024 fundraising trends and deal activities, analyzing fund sizes, regions, sector-focused funds, and types. It also highlights the top-performing PE funds and provides a forward-looking industry outlook.

Summary

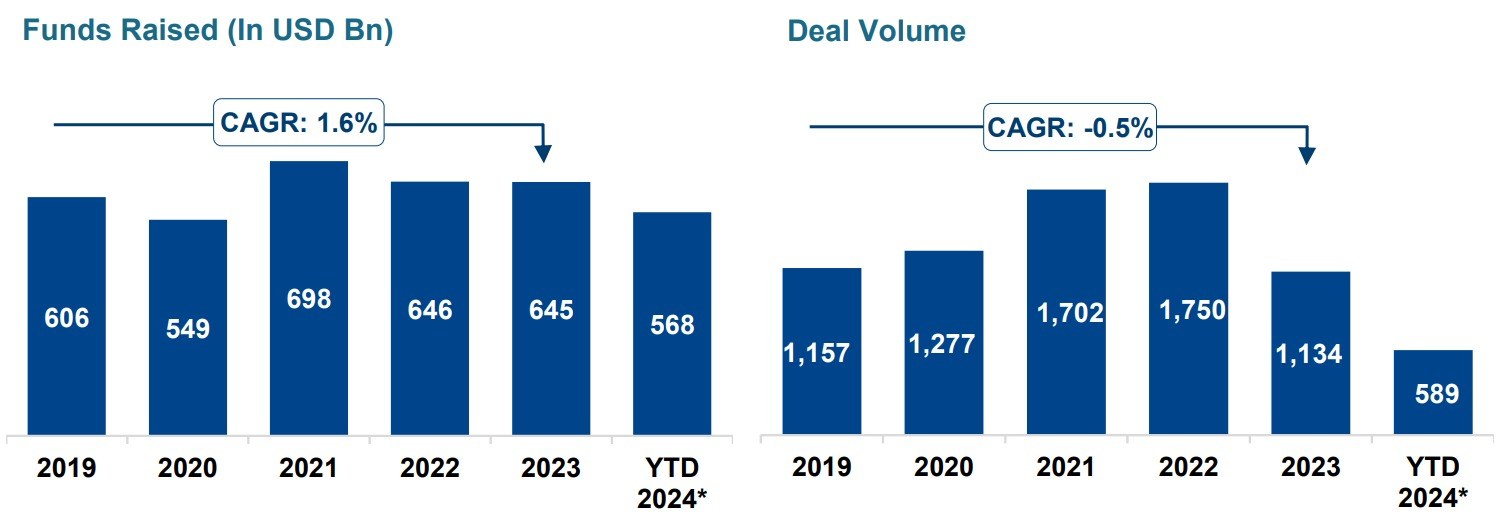

Fluctuations in Fundraising: After a decline in 2020 due to COVID-19, PE fundraising rebounded by 27.2% in 2021. Growth slowed in 2022-2023, with a 6.2% decrease in YTD 2024 compared to the previous year.

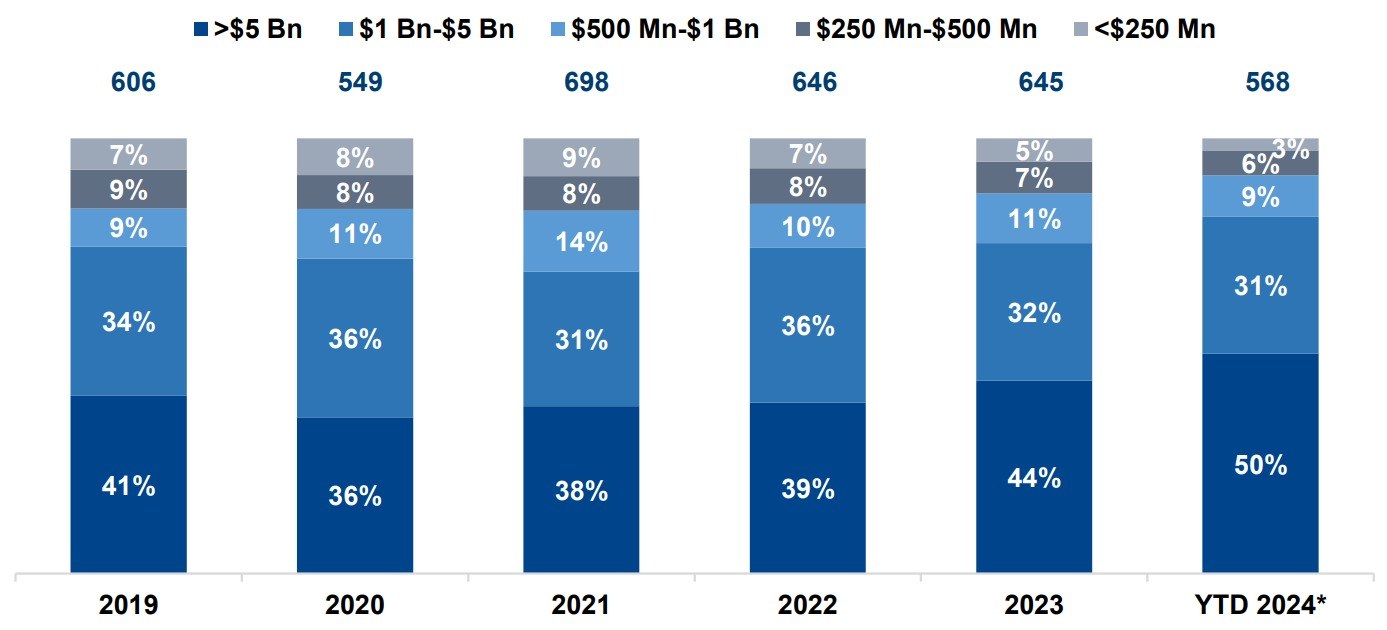

Dominance of Large Funds: Mega (USD 5 Bn+) and large funds (USD 1–5 Bn) contributed 81% of the total capital raised in YTD 2024.

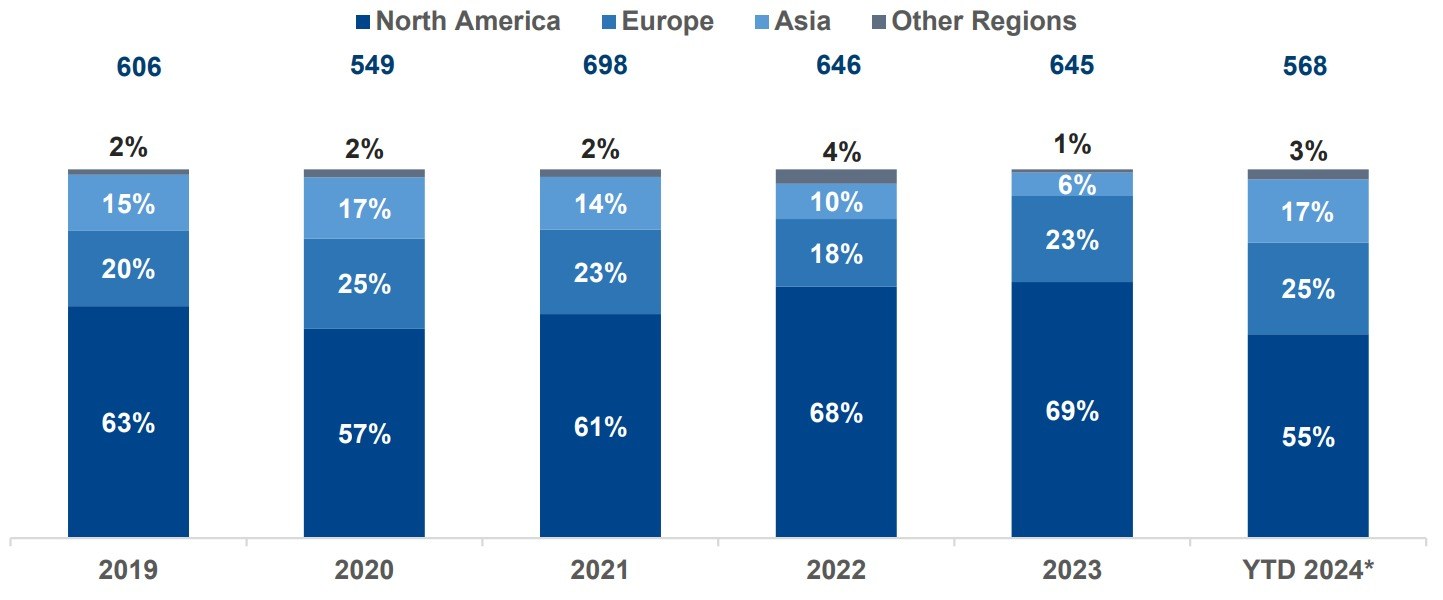

Regional Shifts: North America’s share declined in YTD 2024, while Europe and Asia gained momentum, supported by mega funds and sector-specific opportunities.

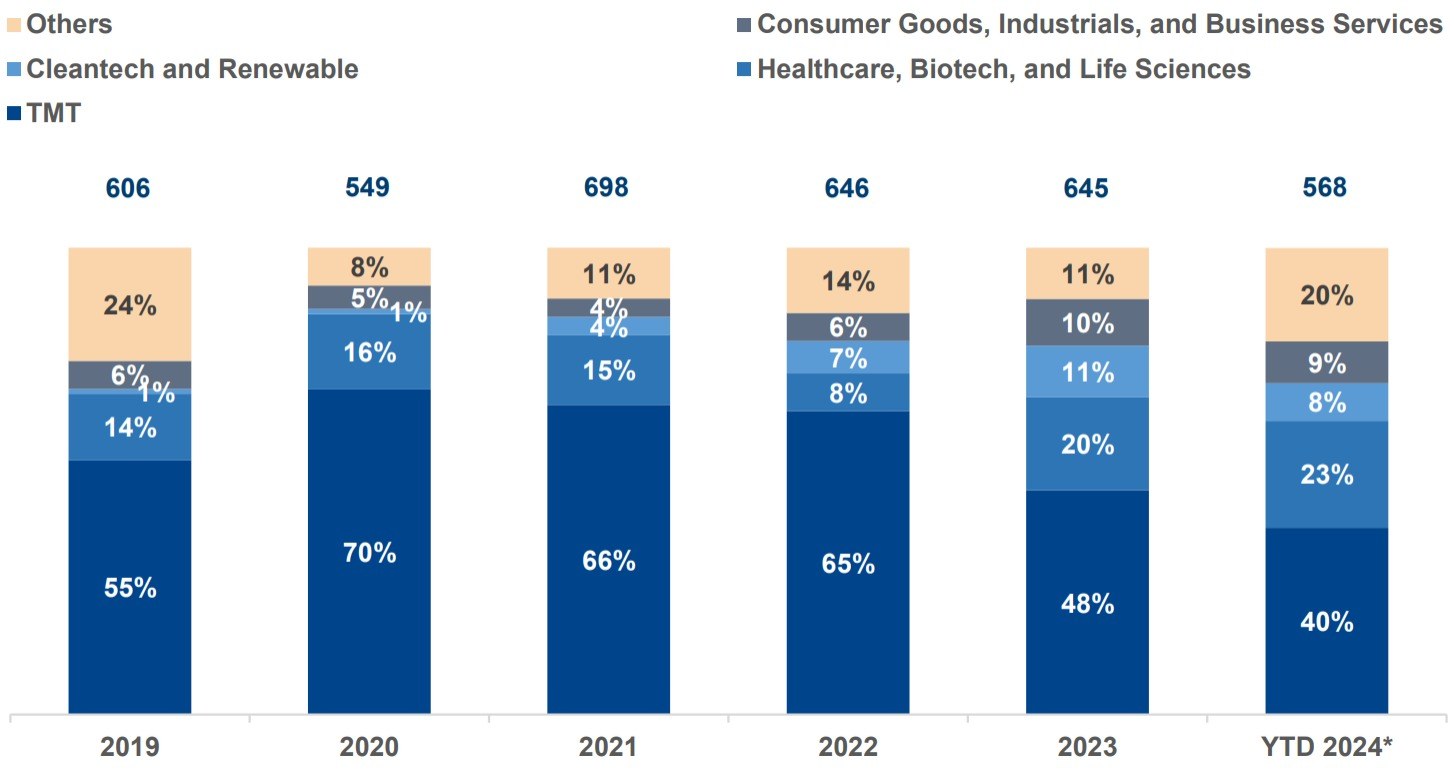

Sector-Specific Growth: Healthcare, biotech, and cleantech funds saw notable growth in funds raised, whereas TMT and energy funds experienced declines in YTD 2024.

Extended Timelines: Fundraising durations have lengthened to 18 months due to stricter regulations and more complex due diligence processes.

Private Equity Fundraising Activity

YTD as of November 2024

In 2020, PE fundraising declined by 9.5% while the total number of fundraising deals increased as firms shifted toward smaller, lower-risk opportunities focused on capital protection and minimizing exposure to economic uncertainty. Fundraising activity rebounded strongly in 2021, with values increasing by 27.2%, driven by economic recovery, low interest rates, and abundant market liquidity. However, deal value growth slowed, declining by 7.5% in 2022 and 0.2% in 2023, as rising economic uncertainties and higher interest rates led to more cautious investor sentiment. As of YTD 2024, capital raised stands at USD 568 Bn, marking a 6% decrease compared to YTD 2023. Despite this, fundraising is expected to surpass the previous year’s total, supported by stabilizing interest rates, easing inflation, and renewed investor confidence.

Fundraising by Fund Size (In USD Bn)

*YTD as of November 2024

Funds larger than USD 1 Bn accounted for 81% of the total capital raised in YTD 2024, driven by funds providing consistent returns and demonstrating greater reliability in uncertain market conditions. Fundraising by mid-sized funds (USD 0.5–1 Bn) grew the fastest (14.2%) in 2023 compared to 2022, owing to their agility in capitalizing on niche opportunities and expanding through add-on acquisitions. Similarly, mega funds (more than USD 5 Bn) grew by 12.7% in 2023 compared to 2022, fueled by significant fundraising efforts in Europe and the US. Conversely, funds under USD 500 Mn and those between USD 1 Bn and USD 5 Bn experienced a decline of 16.3% and 11.5%, respectively, in 2023 compared to 2022, as market uncertainty and high interest rates led investors to favor the perceived safety of larger funds.

Fundraising By Region (In USD Bn)

*YTD as of November 2024

In YTD 2024, North America's share of PE fundraising decreased to 55%, while Europe and Asia gained momentum, capturing 25% and 17% of the market, respectively. Europe’s growth was bolstered by large funds such as EQT ($23.7 Bn), Partners Group ($15.0 Bn), Cinven ($14.5 Bn), and Apax Partners ($12.0 Bn). Similarly, Asia saw a resurgence in activity, led by major funds like TPG Asia ($ 8.0 Bn) and CVC Capital ($6.8 Bn), alongside a recovery in tech and consumer sectors.

Europe’s expansion reflects a broader trend from 2023 when the region experienced a 27.1% year-over-year increase in capital raised, driven by substantial fundraising efforts from U.S.-based firms such as KKR and Bain Capital, which closed significant funds in Europe. On the other hand, North America recorded a modest 1.7% rise in fundraising activity in 2023, supported by mega-funds from firms like BDT & MSD (USD 14.0 Bn), TPG (USD 12.0 Bn), and The Jordan Company (USD 6.9 Bn). In contrast, Asia experienced a sharp 34.1% decline in fundraising during 2023, while fundraising in the Middle East and other regions, including Africa and Oceania, dropped significantly by 73.2% and 79.2%, respectively.

Fundraising by Sector-Focused Funds (In USD Bn)

*YTD as of November 2024 | Other sectors include Financial Services, Real Estate, Transportation, Energy and Oil & Gas, Agribusiness, and Leisure

Fundraising by funds focused on TMT, cleantech, and renewable energy sectors declined in YTD 2024 due to challenges such as market uncertainty, valuation adjustments, capital constraints, delayed project executions, and sector-specific risks, which hindered fundraising efforts. In contrast, fundraising activity in the healthcare, biotech, and life sciences sectors surged, driven by innovation, advancements in healthcare solutions, rising demand from aging populations, and government support and funding.

In 2023, fundraising by funds investing in TMT, healthcare, biotech, and life sciences, and cleantech and renewables collectively accounted for approximately 79% of the total capital raised. Fundraising by healthcare, biotech, and life sciences focused PE funds surged by 149.2% from 2022. Similarly, fundraising in consumer goods, industrials, and business services grew by 66.6%.

Fundraising activity in the cleantech and renewables sectors increased by 56.9% in 2023, supported by capital raised for sustainable energy projects such as solar, wind, green hydrogen, and smart grid technologies. However, fundraising in sectors like TMT, financial services, GP stakes, energy, and other services declined, impacted by volatile commodity prices, a shift toward renewables, and rising interest rates.

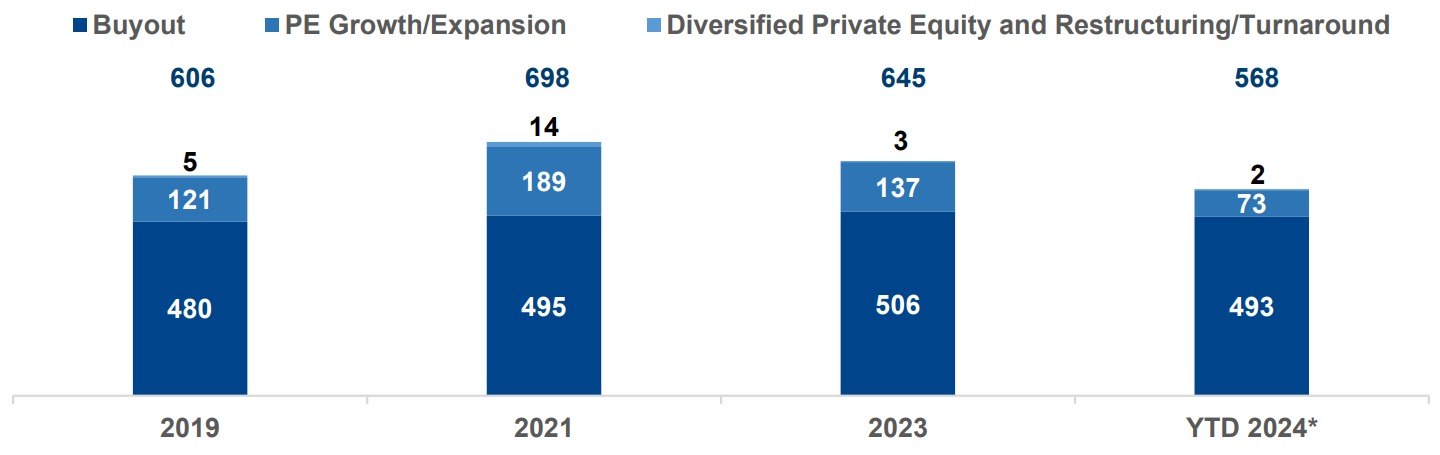

Fundraising by Fund Type (In USD Bn)

*YTD as of November 2024

In YTD 2024, buyout funds dominated PE fundraising efforts, capturing 87% of the total capital raised. This dominance is driven by investors' preference for funds that offer stable returns as well as fundraising strategies focused on mature markets in the US and Europe. Buyout funds also benefited from strong institutional investor demand for larger, established funds with proven records, enabling them to secure commitments more efficiently. In contrast, growth funds accounted for only 13% of fundraising activity as investor appetite weakened due to concerns over higher borrowing costs, reduced liquidity, and fewer exit opportunities, limiting capital flows to growth-focused strategies.

Buyout funds accounted for 78% of the total capital raised in 2023, a significant increase from 71% in 2022. In contrast, growth funds saw a slight decline in their share, from 27% in 2022 to 21% in 2023. The popularity of growth funds peaked in 2021, but their share has steadily declined as investor confidence waned in the face of higher borrowing costs and challenges in securing profitable exits.

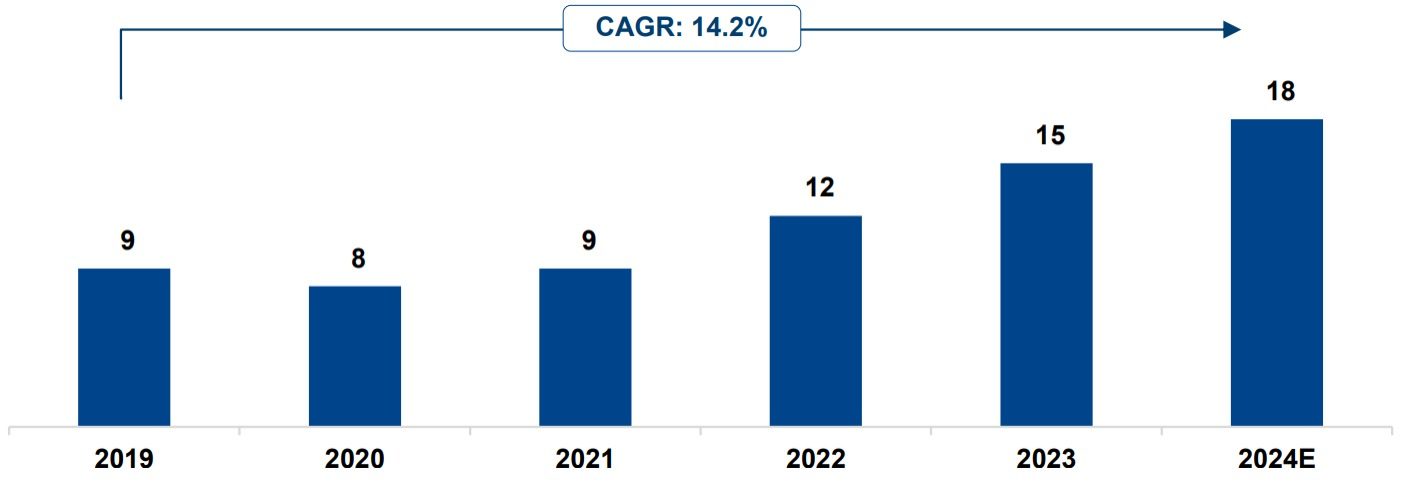

Fundraising Duration (Months)

In 2023, the average duration of the fundraising process, from fund initiation to close, increased to 15 months, up from 12 months in 2022 and 9 months in 2021. This duration is expected to extend further by the end of 2024, with funds projected to take an average of 18 months to close. This anticipated increase is attributed to stringent regulatory requirements and intensified competition for capital. For instance, economic volatility and new environmental, social, and governance (ESG) regulations are expected to prolong due diligence and negotiations, further extending fundraising timelines.

Top PE Funds

Largest PE Funds Closed Since Jan 2023 (By Fund Size)

| Fund Name | Fund Manager | Target Size (USD Bn) |

Current Size (USD Bn) |

Region Focus | Fund Strategy |

|---|---|---|---|---|---|

| CVC Capital Partners IX | CVC Capital Partners | 27.1 | 28.1 | Multi-regional | Buyout |

| Clayton, Dubilier & Rice XII | Clayton Dubilier & Rice | 20.0 | 26.0 | North America | Buyout |

| EQT X | EQT AB Group | - | 24.0 | Multi-regional | Buyout |

| Lexington Capital Partners X | Lexington Partners | 15.0 | 22.7 | Multi-regional | - |

| Strategic Partners Fund IX | Blackstone Strategic Partners | 13.5 | 22.2 | Multi-regional | - |

| Apollo Investment Fund X | Apollo Global Management | 25.0 | 20.0 | Multi-regional | Buyout |

| Permira VIII | Permira Advisers | 16.2 | 18.1 | Multi-regional | Buyout |

| Warburg Pincus Global Growth 14 | Warburg Pincus | 16.0 | 17.3 | Multi-regional | Growth equity |

| TA XV | TA Associates | 15.0 | 16.5 | Multi-regional | Growth equity |

| Carlyle Partners VIII | The Carlyle Group | 22.0 | 14.8 | North America | Buyout |

| Eighth Cinven | Cinven Limited | - | 14.5 | Multi-regional | Growth equity |

| Goldman Sachs Vintage Fund IX | Goldman Sachs Asset Management | Undisclosed | 14.2 | Multi-regional | - |

| BDT Capital Partners Fund 4 | BDT & MSD Partners | - | 14.0 | Multi-regional | Growth equity |

| TPG Partners IX | TPG Capital | 15.0 | 12.0 | North America | Buyout |

| Apax XI | Apax Partners | - | 12.0 | Multi-regional | Buyout |

| TPG Asia | TPG Capital | - | 8.0 | Asia | Buyout |

| CVC Capital Partners Asia VI | CVC Capital Partners | - | 6.8 | Asia | Buyout |

Outlook

PE fundraising is currently navigating a more cautious environment influenced by economic uncertainties, rising interest rates, and inflationary pressures. These challenges have slowed fundraising activities compared to previous years, as investors adopt a more selective approach, favoring funds with established records and experienced managers. Fundraising efforts are expected to be led by seasoned fund managers with strong historical performance, while newer or less-established managers may face difficulties in gaining investor confidence.

Liquidity constraints and growing competition from institutional investors, such as sovereign wealth and pension funds making direct investments, are adding complexity to the fundraising landscape. Additionally, higher interest rates are driving downward adjustments in valuation multiples, potentially affecting fund performance.

Despite these challenges, the outlook for 2024 and beyond is optimistic. Fundraising activities are expected to pick up, supported by stabilizing interest rates, increased focus on sectors like TMT (technology, media, and telecom) and infrastructure, and improving investor confidence. Although global economic growth is anticipated to remain modest, with the IMF projecting 3.3% growth in 2025, risks such as geopolitical tensions and regulatory changes may still impact sentiment.

Nevertheless, private equity remains an attractive asset class, especially during periods of market volatility. Larger funds are likely to dominate, while mid-sized funds, particularly those with niche sector focuses, could experience steady growth. Long-term success will hinge on fund managers' ability to adapt to shifting investor priorities, emerging sector trends, and evolving regulatory frameworks.

Funds that distinguish themselves through innovative strategies, strong ESG alignment, and operational expertise are well-positioned to succeed in the dynamic PE landscape.