Shaping M&A in 2024: Key Trends, Challenges & Opportunities

Published on 03 Mar, 2025

Mergers and acquisitions (M&A) activity in 2024 adapted to evolving macro and monetary conditions. Corporations and investment firms refined their strategies to optimize portfolios, enhance operational efficiency, and strengthen technical capabilities. With investor confidence remaining strong, M&A activity is expected to gain further momentum in 2025. This edition of the M&A Deal Analysis offers an overview of global deal activity, emphasizing key sectors, insights into acquirers, transaction multiples, and notable deals completed in 2024.

Summary

Deal Value & Volume: Total deal value rose 9.2%, while deal volume declined 5.3%. Mega deals drove confidence, despite high interest rates and regulatory scrutiny, supported by lower borrowing costs and regulatory reforms (India’s faster approvals, the US’s transparency measures, the EU’s consolidation efforts).

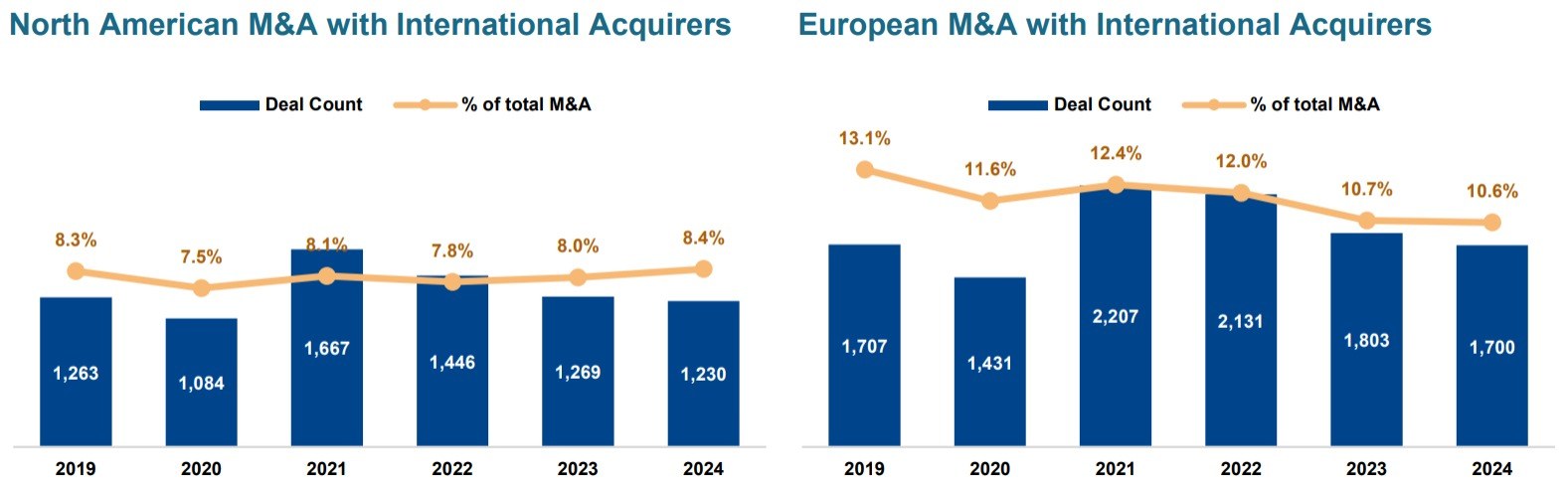

Cross-Border Trends: European targets outpaced North American ones (1,700 vs. 1,200 deals), driven by a strong US dollar and lower European valuations. Trade policies and tariffs may shape future cross-border activity.

Sector Performance:

- Commercial Products & Services: 2% increase in deals, led by industrial & manufacturing M&A.

- Software: Over 3,000 acquisitions worth $181 Bn, with major deals including Ansys ($35 Bn), Splunk ($27 Bn), and HashiCorp ($6 Bn)

- Financial Services: 10% deal growth, highlighted by Arthur J. Gallagher’s $13.5 Bn acquisition of AssuredPartners in the insurance sector.

- Healthcare: M&A remained subdued, with 4% capital investment growth and 600+ deals in Q4 ($56 Bn invested)

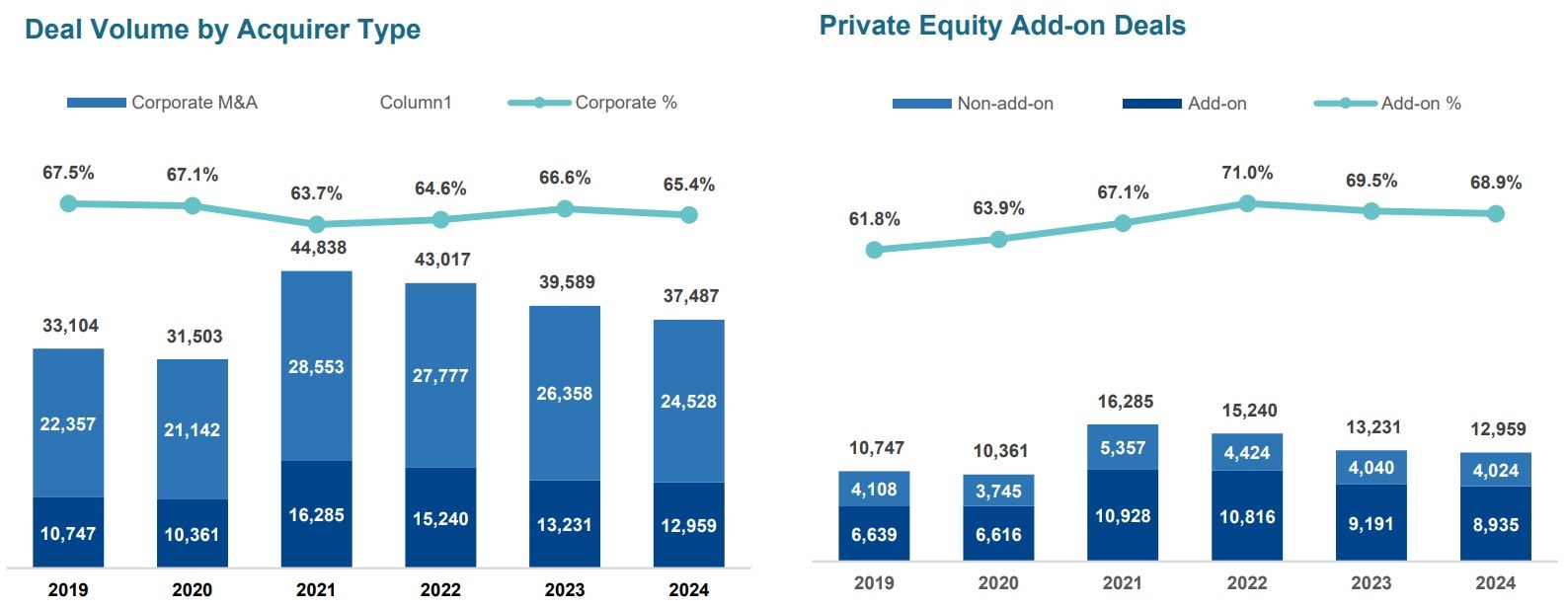

Investor Activity: Corporate M&A dominated the stage (65% of deals), focusing on technology, AI, and business expansion. Private Equity (PE) investors faced financing challenges, but rate cuts boosted add-on deals (~69% of PE transactions).

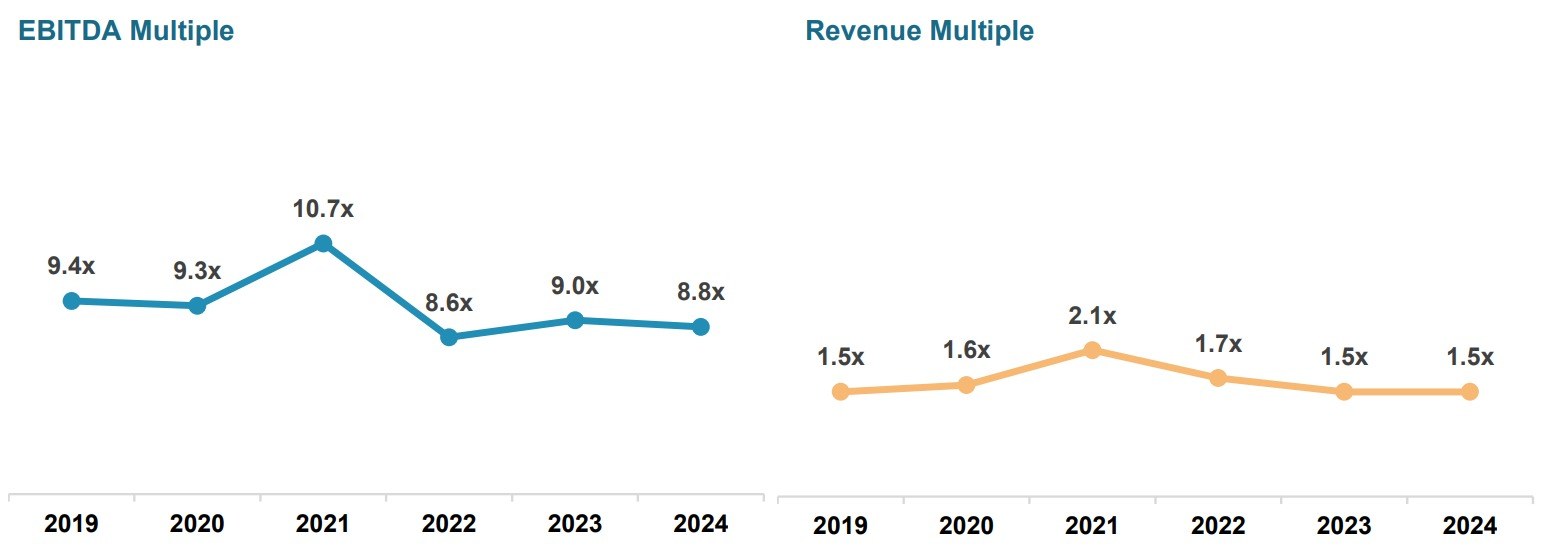

Valuations & Multiples: EBITDA multiples declined to 8.8x (from 9.0x in 2023 and 10.7x in 2021). Revenue multiples remained stable at 1.5x, slightly below the 2017–2019 average. Valuation reset aligns seller expectations with buyer demand.

2025 Outlook: M&As are expected to increase, driven by interest-rate cuts, regulatory clarity, and increased sponsor participation. Tech, financial services, healthcare, and industrial M&A will be key areas of growth. Public market rallies may push private multiples higher, particularly in tech and software. Corporations invest in AI, machine learning (ML), and data analytics, while PE firms optimize portfolios and accelerate exits, bringing high-quality PE-backed companies to market.

Deal Analysis

Global M&A activity remains below the historical average, particularly when compared to the deal surge of 2021. However, the market showed resilience in 2024, despite challenges such as high interest rates and regulatory scrutiny. Deal values increased by 9.2%, reaching $3.4 Tn vs. $3.2 Tn in 2023, while deal volumes saw a slight decline of 5.3%, with approximately 37,500 deals completed.

Current trends indicate a shift toward larger deals, with mega transactions boosting confidence among industry players looking to remain competitive. A key driver of this resurgence was the return of major banks to the deal lending market, intensifying competition with non-banks and lowering borrowing costs for leveraged buyouts. In the US, borrowing rates in the broadly syndicated loan (BSL) market dropped from 11.0% in May 2023 to 9.7% in September 2024, just before the Federal Reserve’s (Fed) rate cut. A similar trend emerged in the Eurozone, where borrowing costs peaked at 9.1% in June 2023, declining to 8.4% by mid-2024, ahead of the European Central Bank’s (ECB) rate cuts.

This environment pushed dealmakers to focus on rapid value creation, prioritizing both revenue growth and cost synergies. Strategic acquisitions became more selective, demanding clearer value propositions and adapting to the evolving M&A landscape by balancing growth opportunities with cost optimization.

Beyond improved financing conditions, M&A activity was further supported by:

- Strong CEO focus on growth and transformation, particularly in Artificial Intelligence (AI)

- Greater capital availability and an increased supply of assets, including PE portfolio companies and corporate divestitures

- Regulatory reforms aimed at streamlining deal approvals, such as:

- India implementing faster approval guidelines

- The Biden administration introducing transparent merger filing requirements, expected to continue under a Trump presidency

- Newly elected EU leaders exploring more openness to intraregional consolidation, though facing potential national resistance

- Japan’s financial authorities promoting M&A through corporate governance reforms

With central banks now aligned in their monetary policies, the M&A market is set to benefit from a second phase of reduced borrowing costs, this time driven by policymakers rather than lenders. While the extent and duration of rate cuts remain uncertain, they are expected to surpass the 70-100 basis point cuts already implemented by lending markets, helping to sustain M&A momentum for at least another year. These favorable conditions position the M&A market for continued strategic dealmaking, as companies focus on adapting, expanding, and creating long-term value in an ever-evolving global landscape.

Cross Border Deal Activity

Cross-border M&A activity in 2024 remained steady compared with 2023, though significantly lower than the elevated levels seen in 2021-22. Most deals continued to favor European targets over North American ones, with 1,700 European deals involving international acquirers, compared with approximately 1,200 for North American targets.

This trend is led by the strength of the US dollar against the euro and pound sterling, along with lower purchase price multiples on European assets, making them attractive to US investors even without currency advantages. However, changing US economic conditions, a new administration, and evolving international policies, including tariffs, could influence future cross-border deal activity.

As the M&A landscape evolves, companies refine their portfolio strategies to achieve scale, expand geographic reach, and unlock new revenue streams. While megadeals will remain a priority, mid-sized cross-border acquisitions could gain traction as businesses seek strategic growth opportunities.

Sector Analysis

Commercial Products and Services (B2B) – Dealmakers closed 2,548 deals in Q4, marking a 2% increase in deal volume, while deal value surged 17% to $105 Bn. Over the year, the sector saw more than 10,000 completed transactions, with total investments exceeding $350 Bn. This strong deal activity was driven by a stable macroeconomic environment, renewed investor confidence, and high-profile mega deals, including:

- SRS Distribution ($18 Bn)

- DB Schenker ($12 Bn)

- Viessmann Climate ($14 Bn)

- Interpublic Group of Companies ($14 Bn)

- Sanyo Techno Marine ($12 Bn)

The deal momentum was led by cash-rich corporations aiming to accelerate growth and expand their market presence. Despite elevated interest rates and election-related uncertainties, buyers remained active in industrial and manufacturing sectors, focusing on diversification, and scaling business capabilities. Additionally, M&A in key strategic sectors, particularly aerospace and defense, saw significant PE-led acquisitions, with notable deals including the acquisitions of BlueHalo and Barnes Group.

Software – Companies continued to prioritize technical capability expansion by acquiring software providers focused on enhancing business productivity. This trend fueled a 7% increase in deal volume, with over 3,000 transactions completed and total investments exceeding $181 Bn.

Key Software M&A Deals in 2024:

- Ansys ($35 Bn)

- Splunk ($27 Bn)

- Altair Engineering ($11 Bn)

- EK Games ($11 Bn)

- HashiCorp ($6 Bn)

Investors placed a strong emphasis on high-quality assets, particularly on software, where high gross margins, strong competitive moats, and compelling value propositions made these acquisitions highly attractive.

Financial Services – The insurance sector played a pivotal role in the financial services rebound throughout 2024 with deal volumes increasing 10% in Q4 while invested capital rose three times during the period. The largest deal of the quarter was the acquisition of AssuredPartners by Arthur J. Gallagher ($13.5 Bn), highlighting the ongoing consolidation within the insurance brokerage industry. In line with the insurance sector, the trend of asset manager consolidation has long been prevalent among traditional asset managers and has now accelerated within the alternative asset management space. The primary objective remains scaling businesses by expanding service offerings. Key deals in Q4 2024 included BlackRock’s $12 Bn acquisition of private credit manager HPS Investment Partners and Ares Management’s acquisition of GCP International. These transactions reflect a strategic push towards diversification and scale, as firms seek to broaden their investment capabilities in a rapidly evolving financial landscape.

Healthcare – Healthcare M&A activity remained subdued in 2024, with deal volumes increasing by just 1% and capital investments rising by 4%. In Q4 alone, over 600 deals were completed, maintaining the pace seen in Q3, with total investments surpassing $56 Bn. M&A activity in healthcare services, pharmaceuticals & biotech, medical devices, and healthcare technology systems is set to gain momentum as regulatory scrutiny on PE investments and antitrust concerns ease in the upcoming months. Lower interest rates, depressed valuations in healthcare services and increasing capital flow into AI-driven healthcare innovations are spurring tech-focused investments. Additionally, insurers are expected to face regulatory hurdles, limiting their ability to execute large-scale deals, while PE investors are expected to shift focus to healthcare retail, capitalizing on evolving industry dynamics. With favorable conditions ahead, healthcare M&A is poised for renewed activity, offering strategic opportunities for both corporate and financial investors.

| Sectors | Deal Count | Deal Size ($ Mn) |

% of total Deal Volume |

% of total Deal Value |

|---|---|---|---|---|

| Commercial Products & Services | 10,533 | 350,772 | 28% | 10% |

| Software | 3,035 | 181,250 | 8% | 5% |

| Consumer non-durables | 1,362 | 70,701 | 4% | 2% |

| Healthcare Services | 1,261 | 69,158 | 3% | 2% |

| IT Services | 1,209 | 111,984 | 3% | 3% |

| Restaurants, Hotels & Leisure | 1,158 | 40,799 | 3% | 1% |

| Transportation | 818 | 25,680 | 2% | 1% |

| Media | 806 | 25,408 | 2% | 1% |

| Retail | 791 | 26,283 | 2% | 1% |

| Insurance | 645 | 62,091 | 2% | 2% |

| Pharma & Biotech | 582 | 153,545 | 2% | 5% |

| Capital Markets | 544 | 66,935 | 1% | 2% |

| Commercial Transportation | 469 | 25,645 | 1% | 1% |

| Exploration, Production & Refining | 448 | 219,702 | 1% | 6% |

| Metals & Minerals Mining | 440 | 55,987 | 1% | 2% |

| 37,487 | 3,400,000 | 64% | 44% |

Investor Analysis

Corporate M&A remained strong in 2024, representing over 65% of total global deals, as companies focused on technology, artificial intelligence (AI), and core business growth. Meanwhile, PE investors faced challenges due to high financing costs and elevated valuations throughout 2023 and 2024. However, recent interest rate cuts have eased financial pressures, enabling PE firms to reinforce their portfolios through add-on deals, which accounted for ~69% of total PE transactions.

Despite improving conditions, PE investors are expected to remain selective, capitalizing on ample dry powder and lower financing costs to drive deal activity into 2025. At the same time, corporations are set to lead M&A expansion, increasingly channeling investments through their Corporate Venture Capital (CVC) arms.

M&A remains a critical tool for corporate transformation, allowing businesses to expand market presence, enhance capabilities, and optimize operations. Deal activity in 2024 was primarily driven by revenue and margin growth, market expansion, technology, and AI integration. Likewise, in highly regulated sectors like banking and insurance, scale-driven M&A is on the rise, helping firms spread compliance costs across a broad customer base.

A growing focus on portfolio optimization has led companies to divest non-core or low-growth assets, creating acquisition opportunities for firms seeking to fill capability gaps. This trend has been especially pronounced in industrials, consumer health, and entertainment, where major corporations have streamlined operations through spin-offs and asset sales. PE firms are expected to accelerate exit activity, bringing high-quality PE-backed companies to market. This shift is driven by General Partners (GPs) seeking strong returns and the need to rebalance portfolios in response to evolving market conditions. With declining financing costs, strategic portfolio realignments, and ongoing digital transformation, both corporate and financial investors are well-positioned to seize M&A opportunities in the coming year.

Deal Multiples

M&A deal multiples have remained relatively stable over the past three years, with a slight decline in 2024, as the median EBITDA multiple fell to 8.8x from 9.0x in 2023, continuing the downward trend from the 2021 peak of 10.7x. A similar pattern was observed for revenue multiples, which remained steady at 1.5x.

Currently, valuations sit slightly below the 2017-2019 averages of 10.0x EBITDA and 1.6x revenue, a logical adjustment given the higher, though easing, interest rate environment. This valuation reset is expected to further support deal activity in 2025, as market stability helps align seller expectations with buyer investment appetite.

Deal Multiples of Key Sectors

| Sectors | EBITDA Multiple | Revenue Multiple |

|---|---|---|

| Commercial Products | 6.4 | 1.2 |

| Commercial Services | 7.9 | 1.2 |

| Software | 14.7 | 2.6 |

| Consumer non-durables | 9.3 | 0.9 |

| Healthcare Services | 14.8 | 1.3 |

| IT Services | 7.5 | 1.6 |

| Restaurants, Hotels & Leisure | 7.7 | 1.9 |

| Transportation | 3.9 | 0.6 |

| Media | 8.1 | 1.6 |

| Retail | 11.4 | 0.3 |

| Pharma & Biotech | 13.2 | 4.5 |

| Capital Markets | 7.9 | 2.8 |

| Commercial Transportation | 4.6 | 0.9 |

| Exploration, Production & Refining | 5.6 | 2.7 |

| Metals & Minerals Mining | 10.9 | 1.7 |

*Includes Median multiples of deals completed in 2024

Outlook

With generational technology reshaping industries, sponsors seeking liquidity, and corporations actively transforming portfolios through M&A, dealmaking is expected to gain significant momentum in 2025. The global M&A landscape will be driven by interest-rate cuts, streamlined regulatory processes, and increased sponsor participation, as well as lower valuations aligning with investor expectations. Additionally, greater macroeconomic and geopolitical stability, along with potential policy shifts under the Trump administration, may further encourage market consolidation.

Sectors such as healthcare, financial services, technology, and industrial production will continue to experience M&A-driven technological advancements, fueling acquisition activity. Meanwhile, investors will prioritize high-value assets that offer both growth potential and stability. PE firms are expected to lead exits and new investments, generating returns for LPs and optimizing portfolios. At the same time, corporations will focus on enhancing operational efficiency and investing in generative AI, ML, and data analytics to strengthen core capabilities.

The valuation gap between the US and Europe may persist, sustaining cross-border deal flows. Public market rallies could drive higher private multiples, particularly in technology, where strategic buyers continue to capitalize on high-margin software assets. The events of 2024 demonstrated that dealmakers are adapting to new market realities, positioning themselves for strategic portfolio realignments and business expansion. With improving market conditions and renewed investor confidence, 2025 is poised to be a strong year for global M&A activity.