Quick Commerce: Tailor-made for Urban India, Here to Stay

Published on 12 Dec, 2024

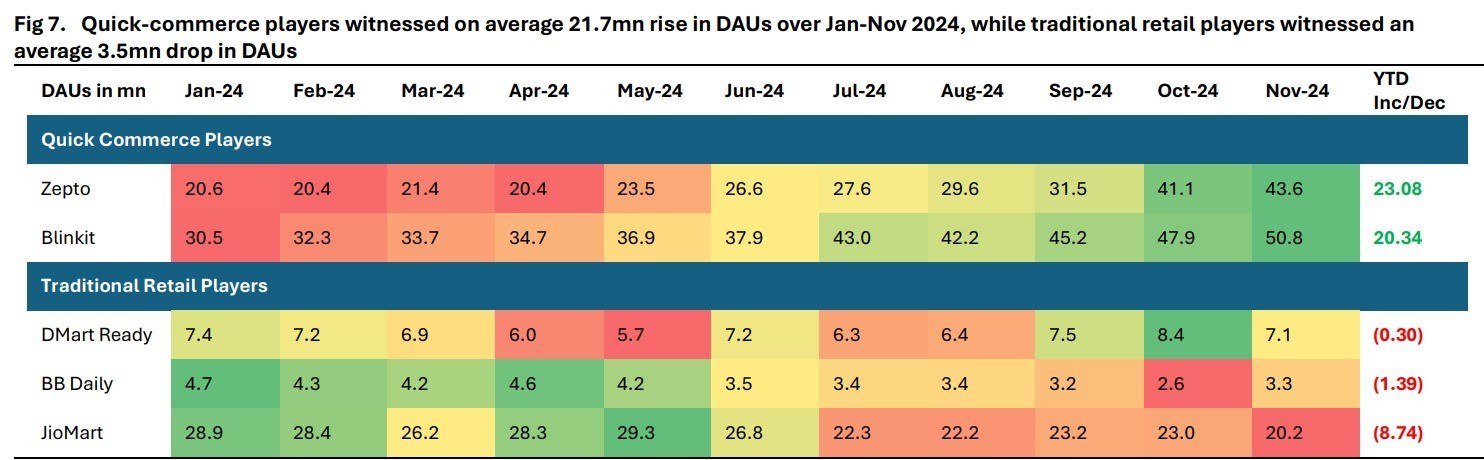

Indian quick commerce market surged 58x from 2019 to $2.3bn in 2023, driven by convenience, curated assortments, and 24/7 service. Initially targeting metro/tier-1 cities for daily essentials, it has now diversified to electronics, beauty, home décor, with ~8,000 non-grocery SKUs surpassing 4,500 grocery SKUs. Analysis of “interest over time” metric for Zepto and Blinkit reveals significant rise in demand in tier-2/3 cities. Meanwhile, traditional retailers like DMart Ready are feeling the impact of quick commerce. Daily Active Users (DAUs) for quick commerce players rose by an average of 21.7mn (Jan-Nov 2024), while DAUs for traditional retailers like BB Daily, DMart Ready dropped by an average of 3.5mn. Quick commerce is projected to grow to $40bn by 2030 (50% CAGR), and is poised to serve 87mn households, fueled by rising incomes and urbanization.

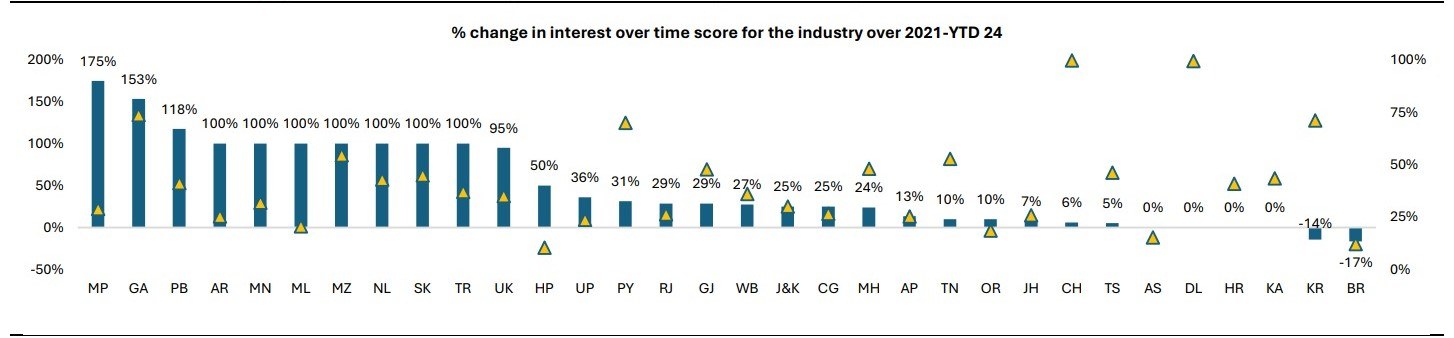

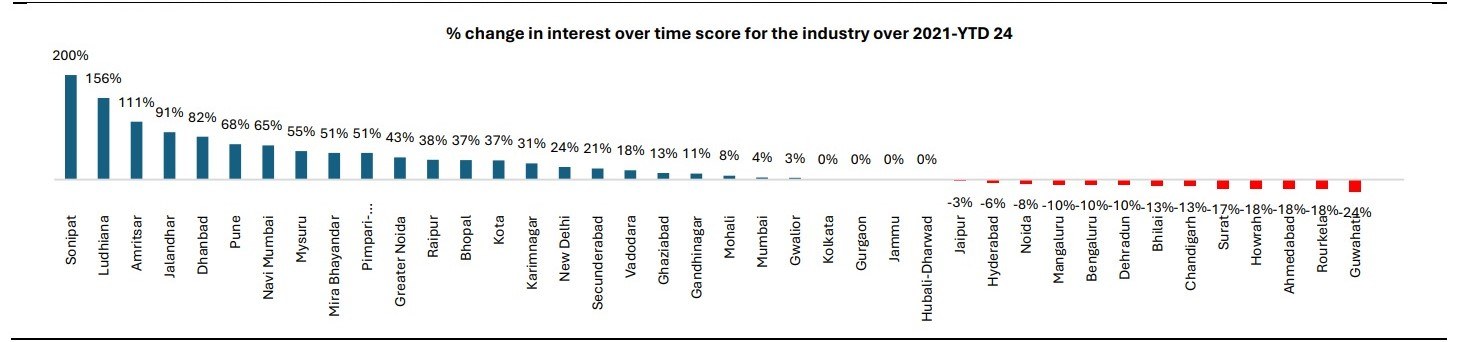

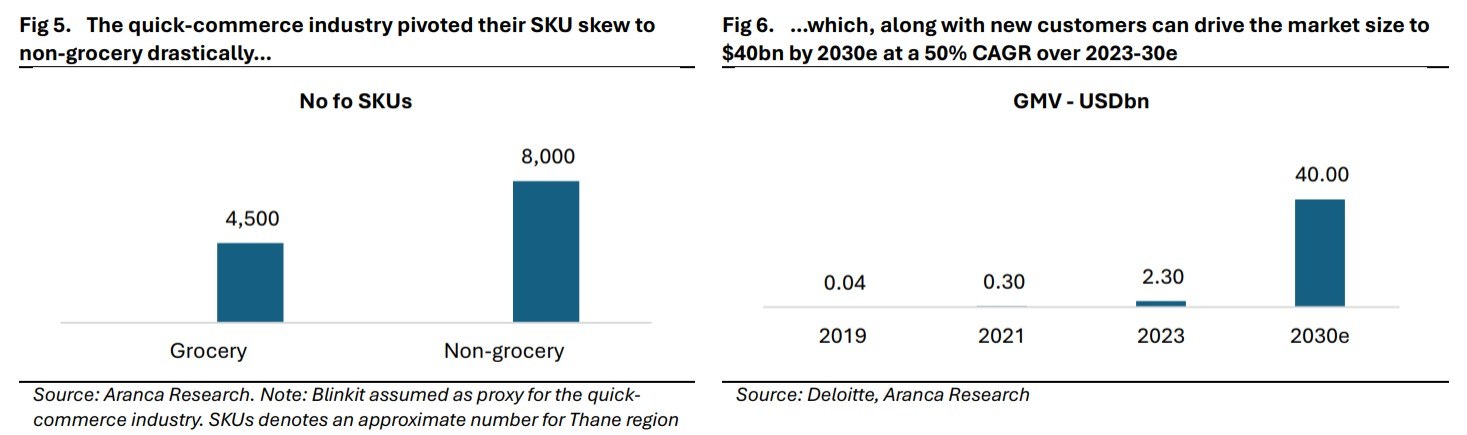

The Indian quick commerce market’s appeal of addressing consumer pressure points, such as i) convenience and comfort, ii) speed and instant gratification, iii) curated assortment and iv) round-the clock standardised service enabled it to evolve 58x times over 2019-23 (from USD 0.4bn to USD 2.3bn). The initial pushback for the market revolved around its appeal being limited to high and mid-income households (HH) in metro and tier-1 cities, and its usage confined to daily essentials like groceries and perishables. However, these pushbacks eventually faded as the incumbents addressed the consumer pressure points. After hooking customers to this service through groceries, incumbents are now enticing them to shop from broad retail categories like electronics, beauty and personal care, home décor and toys and gifts. This migration has led to the quick commerce industry’s SKUs to significantly shift towards non-grocery SKUs of ~8,000 versus grocery SKUs of 4,500. A wide product offering, coupled with speedy delivery and a return facility, has driven customer engagement. We gauged customer engagement by analysing the “interest over time” metric for Zepto and Blinkit, capturing the interest for quick commerce service in tier-2/3 cities versus its peak over 2021 to YTD-24. These findings suggest that states with lower per capita income have shown a significant rise in engagement, indicating a growing demand for these services beyond metros. Traditional retail channels like DMart Ready have already started to feel the brunt of quick commerce. Its management admitted that its sales in stores situated in metro cities were impacted due to online grocery channels, as consumers seek convenience and instant gratification. This is also evident from our Daily Active Users (DAUs) analysis, which suggests an average 21.7mn rise in DAUs in quick commerce companies like Zepto and Blinkit over Jan-Nov 2024, while an average 3.5mn decrease in DAUs in traditional retailing players like BB Daily, DMart Ready and JioMart.

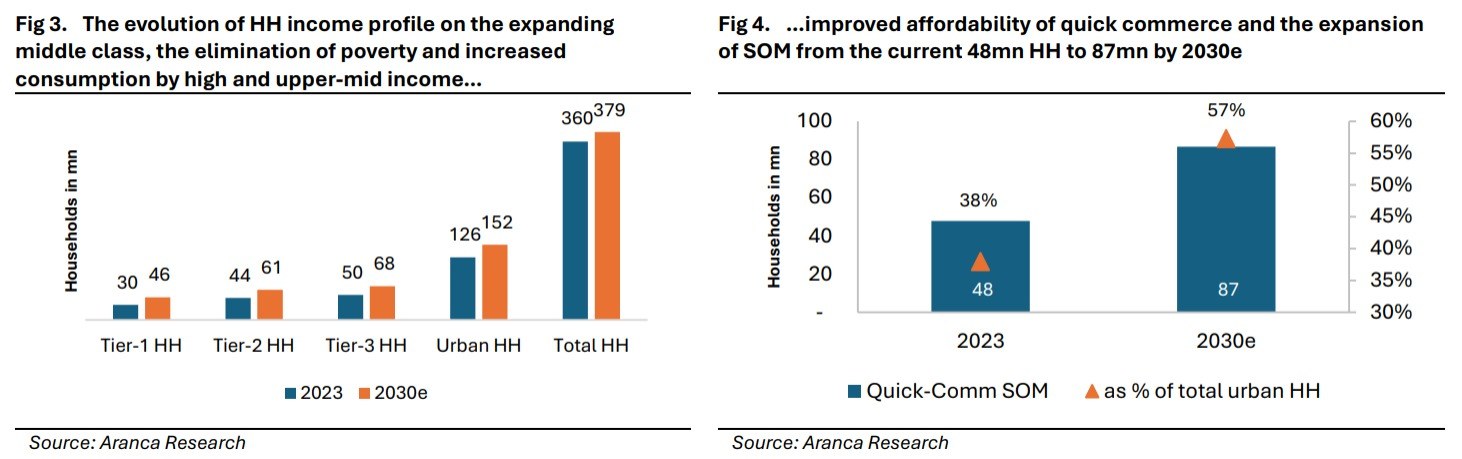

We believe that the Indian quick-commerce market is poised for buoyant growth. It could grow from its current size of USD 2.3bn to USD 40bn by 2030e, implying a strong 50% CAGR over 2023-30e. Based on our estimates, the market currently caters to 48mn HH but can surge to 87mn by 2030e, driven by evolving customer preferences, rising HH-income profile and urbanisation. This strong growth will likely be driven by the confluence of i) increasing cross-selling opportunities through the expansion of product assortments, and ii) new customer additions by expansion into tier-2/3 cities. As these smaller cities get urbanised, we believe that quick commerce services will no longer be restricted to metros and tier-1 cities.

Fig 1. Significant surge in the Interest Over Time score of the quick commerce industry in states with low per capita income. This surge in states with limited or negligible services could signal an increased requirement of quick commerce services

Source: Google Trends. Note: Interest Over Time is the summation of score for Zepto and Blinkit

Fig 2. Quick-commerce expanding beyond metros to tier-1/2 and other smaller cities, driven by round-the clock services, standardised after-purchase, rising discounts and the appeal of speed and convenience over the traditional channels

Source: Google Trends. Note: Interest Over Time is the summation of score for Zepto and Blinkit

Source: Data.ai, Aranca Research. Note: DAUs for Android