Shrinkflation in the US

Published on 09 Nov, 2022

Shrinkflation is a form of inflation where companies reduce the product size, quantity, or quality to maintain or increase their profit margins. A common practice during high inflationary periods, shrinkflation is preferred when companies are hesitant to raise product prices amid rising operating costs. To avoid facing consumer backlash, companies sneakily practice shrinkflation, which, coupled with consumer ignorance, makes it hard to detect. Consequently, consumers may end up purchasing two packets of a product, for example, if its size is reduced by fourth. Thus, shrinkflation may not only help in maintaining margins but also boost sales. When accused of shrinkflation, companies may give several reasons such as health, environment, and better value addition. Inflation is transparent, but shrinkflation is underhanded and thus could be difficult to calculate and tackle.

Introduction

Inflation has been steadily rising across most developed economies, reaching decade-high levels in countries such as the US and UK. However, firms that raise product prices may face backlash from consumers and be accused of profiteering. Consumer confidence also slumps during periods of high inflation. Shrinkflation, also known as product downsizing, is a stealthy form of inflation where companies reduce the product's quantity or size instead of increasing its price. Sometimes, the product's quality is compromised while the original quality is sold at a higher cost. Firms downsize due to rising operating costs or in order to sustain margins without giving the impression of price hikes. Furthermore, firms actively try to hide downsizing fearing repercussions from consumers. As a result, many buyers do not notice shrinkflation and may even purchase more than they require.

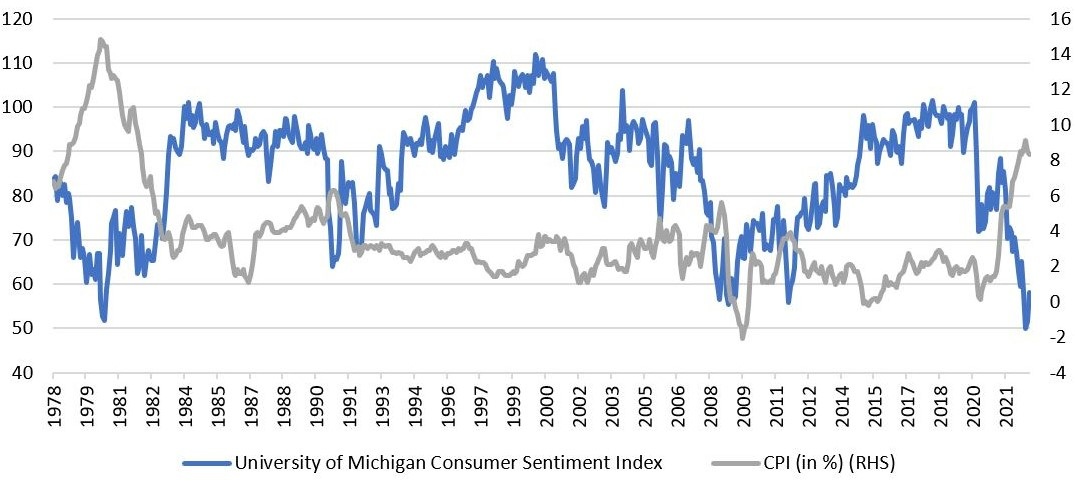

US Consumer Confidence Inversely Related to Inflation

Source: Bloomberg

Reasons for Shrinkflation

- Higher manufacturing costs: Higher manufacturing costs are a primary reason for shrinkflation. Companies counteract higher costs for producing the same product without price hikes by selling smaller quantities at the same price; this also ensures their profit margins are sustained.

- Inability to pass rising costs to customers: Some companies are unable to pass on the rising costs to customers without leading to a drastic fall in sales. Products with several close substitutes have high price elasticity and face this issue.

Consumer Psychology

Some think of shrinkflation as a cost-cutting strategy adopted by companies, but this presents an incomplete picture of the concept. To understand the market strategy behind shrinkflation and consumer psychology, it is crucial to learn about the price pack architecture, consumer buying behavior, and pricing and packaging strategies undertaken by various companies.

Price Pack Architecture: A price pack architecture involves optimizing product variations to enhance margins and increase category share. For instance, for a specific product, in terms of pack size selection, price sensitivity, and channel preference, immediate purchase or consumption would be quite different from the stock-up purchase made towards the beginning of the month. The price purchase architecture serves as an analytical technique that permits companies and brands to ensure they can offer products that meet consumer needs and preferences at a price they are willing to pay in order to satisfy those needs. Using the price pack architecture, a brand constantly changes packages by decreasing or adding items from its product line. One successful example of price pack innovation in the US was PepsiCo's smaller cans. In 2013, PepsiCo offered its beverage in smaller cans, which allowed consumers to indulge in carbonated beverage with lower sugar and calorie intake.

Consumer Buying Behavior: Consumers may not notice the effects of shrinkflation at first as there is a marginal decrease in quantity; however, they pay the same price for lower quantity. Shrinkflation is a hard reality for consumers already struggling with inflation. As much as consumers dislike inflation, they are against shrinkflation. Inflation can be transparent and consumers are aware of fluctuating prices, but they do not prefer purchasing two packets when one was sufficient to satisfy their needs earlier.

Pricing and Packaging Strategies: Another factor influencing consumer psychology during shrinkflation is packaging. From chips to yogurt, and coffee to toilet paper, manufacturers worldwide are gradually shrinking package sizes while keeping the prices intact. In the US, Domino's Pizza decreased the size of its 10-piece chicken wings to eight without changing the prices, and Gatorade replaced its 32-ounce bottles with 28-ounce ones. Consumers may not notice these minuscule changes but brands profit from them.

Case Studies

The infographic shown above is a pictorial depiction of what happens in a shrinkflationary environment. In an inflationary environment, a 100 ml product costing USD10 would be sold for USD11 without any change in quantity. However, shrinkflation would cause a reduction in quantity to 80 ml without any price change.

Toilet Paper: Earlier, 1,000 sheet toilet paper rolls were standard, which made it easier to compare. However, due to inflation, companies have reduced package sizes in two ways:

- Reducing number of sheets: Companies have decreased the number of sheets. A Charmin roll, which used to have 650 sheets, is now charged extra for Mega Rolls, which have fewer sheets. Such reductions make comparison more difficult.

- Shrinking toilet paper size: Many companies shrink the size of the sheets. Some have reduced the size from 4.5 inches to 4 inches, down 11.1%. Charmin has also decreased the size of its toilet paper.

Cereal: Cereal is another popular victim of shrinkflation. General Mills minimized the quantity in the family-size box of Cheerios from 19.3 ounces to 18.1 ounces but increased the box size; it applied the same strategy with Cocoa Puffs. The quantity in Lucky Charms, another cereal by General Mills, was lowered from 16 ounces to 14.9 ounces. However, the box size remained the same and was renamed to Large Size, giving the impression that the new box contained more cereal. General Mills responded to shrinkflation charges by claiming the larger box size benefited the environment and provided the best value to the consumer.

Mondelez: Global snack giant Mondelez International, Inc., well-known for its iconic Cadbury chocolate bars, has shrunk the size of its Dairy Milk chocolate without any increase or decrease in price. In 2020, the corporation faced severe accusations of shrinkflation as the product size reduced while net revenue from the chocolate segment surged.

Mondelez – Net Revenue from Chocolate Segment (USD Million)

Source: Mondelēz International, Inc. SEC Filings

Popular treats including Twirl, Crunchie, and Wispa bars saw a reduction in size. The companies state the size shrink was largely enforced to lower the calorie content in their chocolates, but the strategy may have been triggered by soaring inflation across the globe.Consumer Response to Shrinkflation

While consumers are hyperalert to inflation, they are not very observant of shrinkflation. According to a survey conducted by Morning Consult on shrinkflation, around 54% of Americans have heard, seen, or read something about shrinkflation and around two-thirds of them (64%) are concerned about it. Moreover, if brands expect shrinkflation to go unnoticed, they may have to reassess their strategy as the survey shows that only a small portion of Americans (25%) claimed they did not observe shrinkflation in any grocery category. The categories that specific demographics manage to buy more often are the ones in which they may notice shrinkflation versus other products. For instance, Gen Xers and millennials are more likely to observe shrinkflation in meat and produce, whereas boomers tend to notice it in pantry items.

Categories Where Respondents Observed Shrinkflation

Source: Morning Consult

Customers are reacting differently to shrinkflation. The survey shows almost 48% of consumers opted to purchase a different brand and 49% chose a generic product instead during shrinkflation. Retailers and manufacturers need to keep a close watch if the situation persists. Companies' top lines could take a severe hit when a large number of consumers start making similar trade-offs.

Conclusion

Shrinkflation is simply downsizing a product while maintaining a constant price range. When inflation is surging, companies tend to downsize as consumers are price-sensitive and may not notice a subtle change in product packaging or carefully read details about the weight and size of the product. Shrinkflation is not a new strategy, but it becomes common during rising inflation or product shortage. Consumers end up paying more for their regular purchases while companies benefit from this ambushed strategy.