Smart Real Estate Investing: From Brown to Green

Published on 03 Jun, 2024

The global community stands at a crossroads in its journey toward a sustainable future. Today's actions will impact future generations, presenting both challenges and opportunities amid the ongoing climate crisis. While addressing climate change is imperative, it also catalyzes innovation for a better world. This helps prioritize both stakeholder value and sustainability concurrently. With the technology revolution unfolding, the real estate sector holds the potential to lead sustainable development. In this transformative scenario, private equity (PE) firms can play a significant role in encouraging environmental and social responsibility.

In today’s world, where sustainable development is non-negotiable, the real estate sector is shifting toward eco-consciousness. This shift addresses growing environmental challenges and defines luxury and exclusivity. Consequently, the increasing demand for green real estate investments shows a preference among discerning individuals for eco-friendly and elegant properties.

PE and VC firms employ diverse methodologies for assessing a company's equity value, including the income, market, and cost approaches. An investor evaluates the applicability of different valuation methodologies based on several factors, including, but not limited to, the company’s development stage, significant milestones in its business plan, its operating history, the industry in which it operates, quality of relevant data for each approach, etc.

Understanding Green Real Estate

Green building represents commitment to environmental responsibility. These properties are designed, constructed, and operated to minimize environmental impact and maximize efficiency and sustainability. They prioritize energy efficiency, water conservation, use of eco-friendly materials, and healthy indoor environment.

Role of PE Firms in Sustainable Real Estate

PE firms play a crucial role in promoting sustainability in the real estate sector, utilizing financial resources, industry expertise, and extensive networks. They pursue projects aligned with sustainable principles, aiming for both attractive financial returns and positive environmental and community impact. Their strategic approach involves investing in real estate projects that support economic growth and sustainability goals.

Environmental Considerations in Sustainable Real Estate Investments

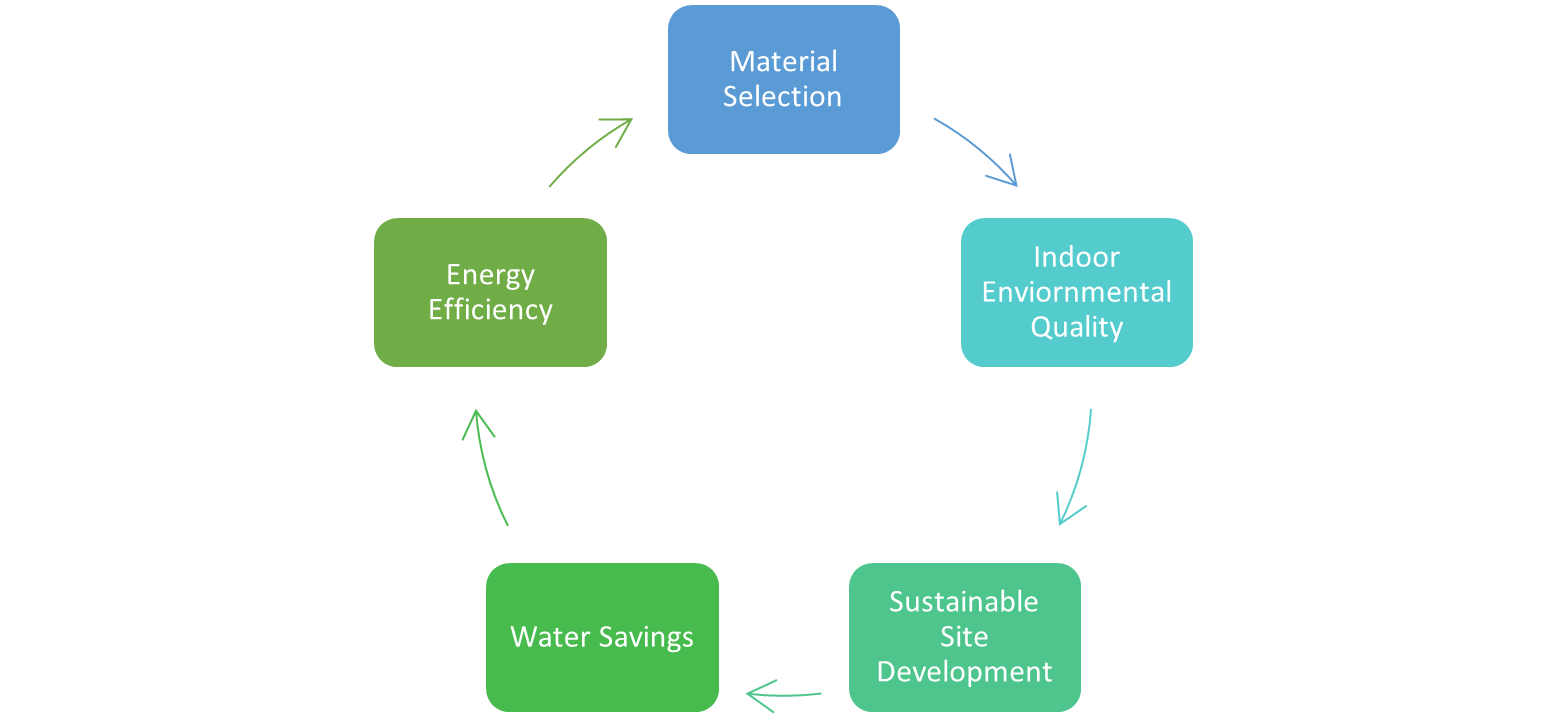

Source: Aranca Research

- Energy Efficiency: Green buildings use energy-efficient technologies and design approaches to minimize energy usage in heating, cooling, lighting, and appliances, thereby reducing reliance on fossil fuels and mitigating greenhouse gas emissions. By investing in sustainable real estate, PE firms can promote green building practices.

- Resource Conservation: PE firms engage in green construction practices that focus on minimizing material usage, encouraging recycling and reuse, and reducing waste during construction and demolition. This will help preserve natural resources, reduce landfill use, and create additional revenue through energy generation.

- Water Conservation: PE firms prioritize projects incorporating water conservation practices. For instance, in sustainable real estate investments, it is essential to hire a skilled plumber with expertise in eco-friendly plumbing to uphold their commitment to environmental and social responsibility.

- Environmental Quality: PE firms invest in green buildings, which prioritize occupant well-being through proper ventilation, natural lighting, and low-emission materials, thus enhancing indoor air quality and diminishing pollutant exposure. Moreover, sustainable site selection helps conserve ecosystems, protect biodiversity, and minimize habitat disruption.

Social Responsibility in Sustainable Real Estate Investments

- Affordable Housing Initiatives: PE firms acknowledge the demand for affordable housing in various communities and invest in projects focused on developing or renovating properties. These investments can help provide secure and affordable housing, promote social equity, and mitigate homelessness.

- Community Development and Empowerment: Besides promoting affordable housing, PE firms prioritize community development by investing in projects that foster vibrant, inclusive neighborhoods. These initiatives integrate amenities such as parks, schools, healthcare facilities, and cultural spaces, ultimately improving residents' quality of life, fostering social bonds, and empowering communities for sustainable growth.

- Health and Well-Being Enhancements: PE firms emphasize social responsibility by promoting health and well-being through sustainable real estate investments. They prioritize projects with features such as indoor air quality, access to natural light, and spaces encouraging physical activity. These investments aim to create healthy living environments, positively impacting public health.

- Accessibility and Inclusively Measures: PE investors recognize the significance of accessibility and inclusivity in real estate endeavors. They support initiatives integrating universal design principles, ensuring spaces are accessible to individuals of all abilities. Such investments promote equal opportunities and social integration for people with disabilities.

Financial Advantages of Sustainable Real Estate Investments Include:

- Enhanced Occupancy Rates: Properties with sustainable features attract tenants, reducing vacancies for steady rental income or quick sales.

- Low Operational Expenses: Energy-efficient technologies reduce energy and utility costs, while water-saving fixtures decrease water usage and costs.

- Appreciating Market Value: Growing emphasis on sustainability in property valuations boosts the value of sustainable assets over time. Regulatory support and government incentives further elevate market worth.

PE firms strategically leverage these benefits, aligning profitability with sustainability in their investment portfolios. Recognizing the long-term viability of sustainable real estate, they position themselves as leaders in an evolving market, contributing to a sustainable future.

Trends in Green Real Estate Investment

- Increased demand for eco-friendly real estate investments has prompted the industry to adopt innovative practices prioritizing environmental well-being.

- Individuals and businesses are actively aligning their lifestyles and operations with eco-conscious values.

- Modern residences are incorporating renewable energy sources such as solar panels and geothermal systems, setting a new standard for eco-luxury living.

- This shift includes the integration of smart technologies, such as intelligent lighting systems and energy management solutions, to optimize resource consumption and ensure energy efficiency.

- Green real estate development is embracing eco-friendly materials and construction practices, including recycled materials and green roofs, reflecting a broad industry commitment to sustainable and responsible building methods.

Major Environmental PE Deals: Construction & Real Estate (Since 2022)

Target |

Acquirer |

Deal value (mn) |

Month of announcement |

Deal type |

|---|---|---|---|---|

NWS |

Chow Tai Rook Enterprises |

$4,534 |

June 2023 |

PE |

Ssangyong C&E |

Coller Capital; Hahn |

$1,500 |

July 2022 |

PE |

Votorantim Cimentos |

International Finance |

$150 |

July 2023 |

PE |

Yak Access |

Platinum Equity |

$121 |

March 2023 |

PE |

Pomerleau |

Caisse de depot et placement du Quebec |

$110 |

December 2022 |

PE |

Source: GlobalData Construction Intelligence Center, Capital IQ

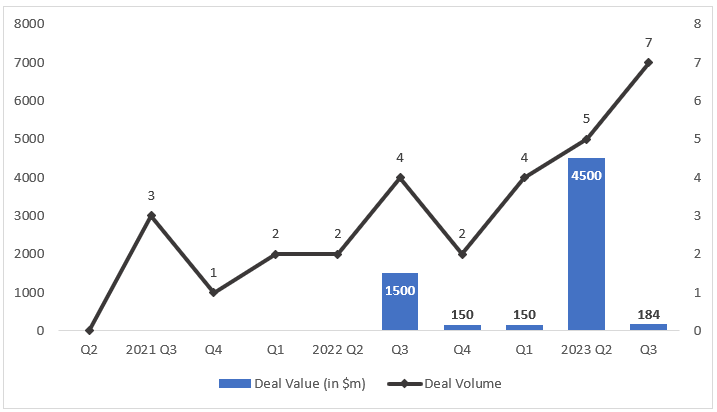

Environmental Sustainability PE Deals: Global Real Estate Q2 2021-Q3 2023

Source: GlobalData Construction Intelligence Center, Capital IQ

In Q3 2023, deal activity related to environmental sustainability declined a significant 96% compared to the previous quarter's total of $4.6 billion and fell 88% compared to Q3 2022. This can be attributed to the impact of rising rates and widening gap between buyer and seller price expectations, which influence both deal activity and fundraising within the sector. Despite the decrease in deal activity, related deal volume increased a notable 40% in Q3 2023 compared to the previous quarter and was 75% higher than in Q3 2022.

Challenges and Risks for Green Real Estate Investment

Green real estate investments offer extensive benefits, but it is essential that investors consider associated risks and challenges. Initial high costs may dissuade some investors; however, the long-term gains in savings and heightened market value surpass the initial investment.

However, potential regulatory changes and compliance challenges can negatively affect the profitability of green real estate projects. To navigate these challenges successfully, investors must stay well-informed and adapt to evolving regulations to achieve success in the green real estate sector. Furthermore, the scarcity of skilled professionals and green building materials underscores the importance of sourcing expertise and materials from trusted partners. By proactively addressing these challenges and aligning with reliable industry partners, PE investors can maximize the positive impact of green real estate investments while mitigating potential risks.

Conclusion

The green real estate market holds untapped demand for sustainable solutions, offering substantial growth opportunities. Capital access through green bonds, banks, and real estate investment trusts (REITs) focused on sustainability enhances this potential. Collaborating with local players is crucial for sustained growth. Strong leadership, stakeholder collaboration, and an environmental, social and governance (ESG) framework are vital for a future-ready economy.

As we progress into 2024, green construction is not just a trend but a fundamental shift. Notable projects such as Casa Adelante 2060 Folsom and Confluence Park, along with emerging trends such as government-driven expansions and green hydrogen, signify the construction industry's leadership in sustainability. The real estate industry's commitment to environmental efficiency ensures a future where green construction is the norm. PE firms can significantly contribute to this outlook by embracing sustainable real estate investments, driving positive change while yielding favorable financial returns. Their consideration of environmental and social factors in investment strategies will help them align with the broad goal of fostering a more sustainable and inclusive future.