US Banks Cut Office Portfolio Amid Market Stress

Published on 21 Jun, 2024

Since the onset of the pandemic, the US office segment has been facing multiple headwinds from elevated vacancy rates, higher interest rates, and a drop in property valuations. This has resulted in a rise in loan delinquencies, prompting commercial banks to shift their lending exposure away from office properties to other segments such as multifamily properties that are relatively performing well.

Demand for office spaces in the US declined since the onset of the pandemic due to the adoption of remote work policies, resulting in a surge in vacancy rates for office properties in metro cities from ~17% in March 2020 to 19.8% in March 2024.

Source: Bloomberg.

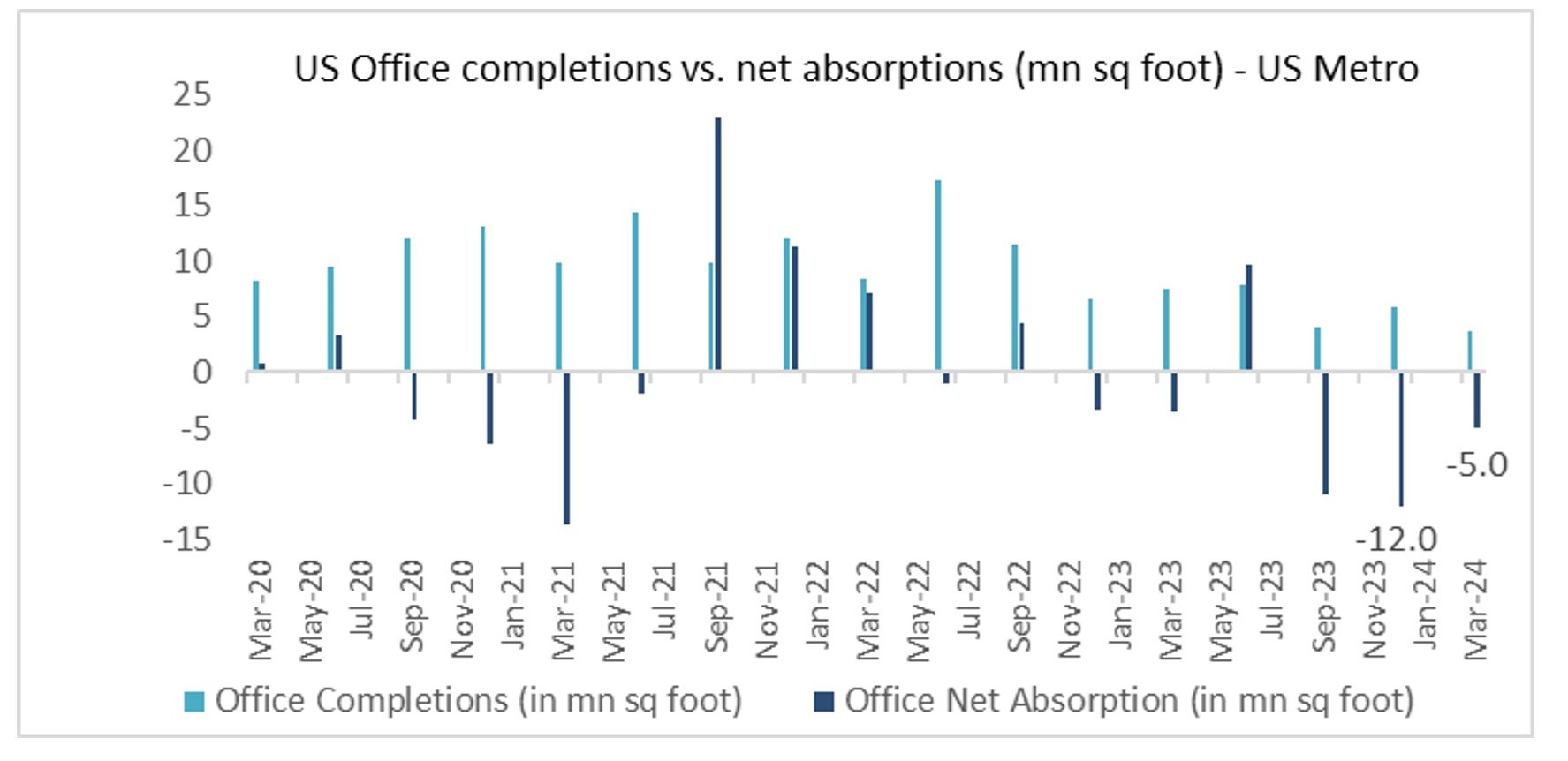

The remote work arrangement has led organizations to abandon plans for new offices, reducing the need for physical workplaces and resulting in negative net absorption levels (the difference between office space that is physically occupied and vacated during a specific period) as office supply continues to increase relative to demand.

Source: Bloomberg.

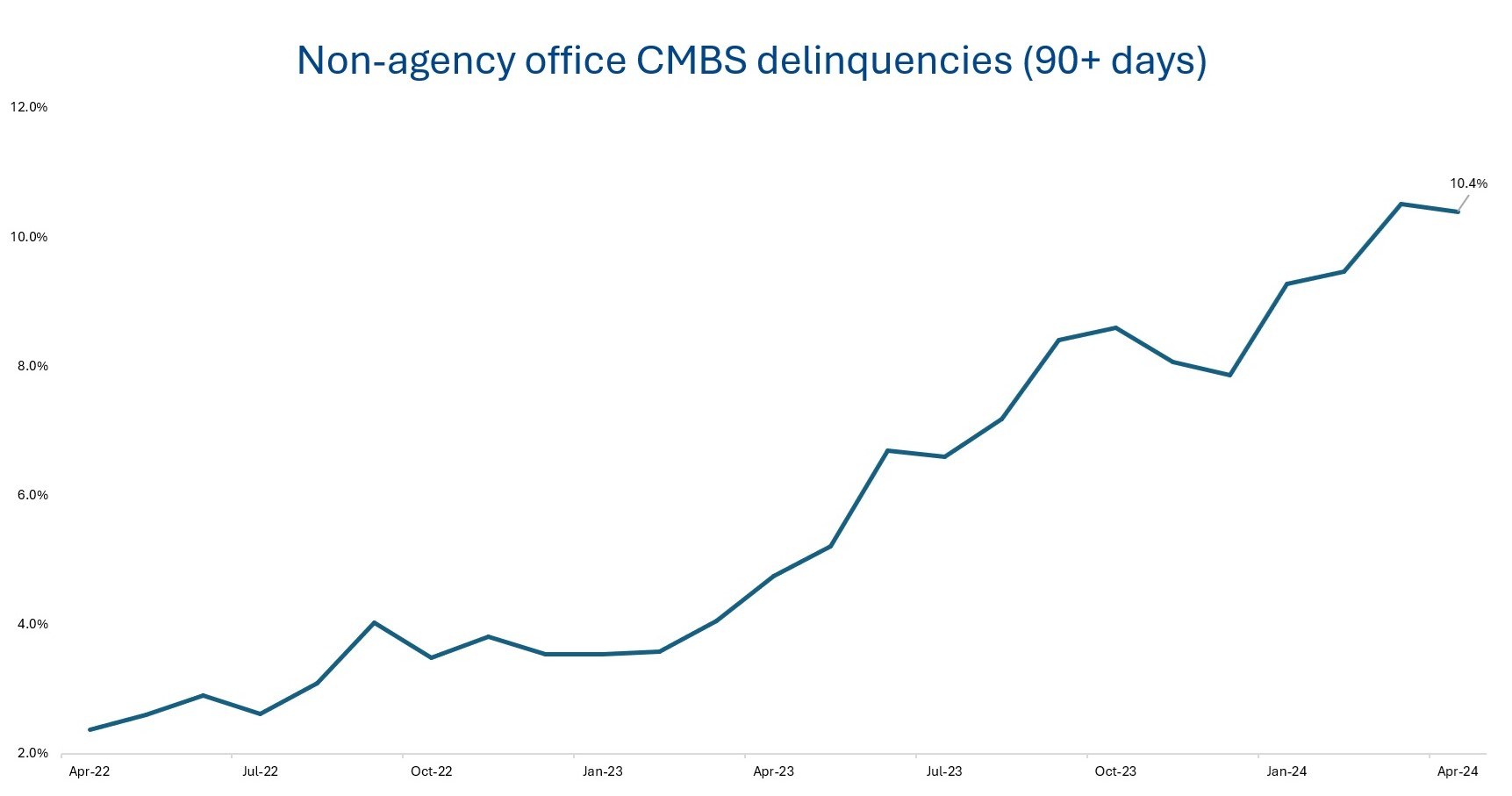

High vacancy rates, coupled with a rise in borrowing costs, have created a challenging environment for office building owners to repay their loans, leading to an increase in delinquencies. As a majority of loans on office properties are used as underlying collaterals in the issuance of commercial mortgage-backed securities (CMBS) securities, the effect of missed payments of these loans has cascaded into the CMBS market. Regulatory sources indicate that delinquencies in office loans used as collateral in CMBS have been rising since early 2023 and reached a record 10.4% in April 2024.

Source: Bloomberg.

The surge in delinquency rates has led to significant valuation downgrades and the booking of some heavy losses in not only riskier tranches but also top-rated CMBS tranches. According to recent reports from Barclays, investors in an AAA tranche of a $308 million note backed by a mortgage on a commercial building in midtown Manhattan received less than 75% of their original investment after selling the loan at a steep discount, while five of the lowest tranches were completely wiped out.

As of December 2023, total US commercial real estate (CRE) loans outstanding stood at $5.89 trillion, with 49.9% (or $2.9 trillion) provided by banks, while financing through CMBS issuances constituted 11.7% of the total outstanding loans.

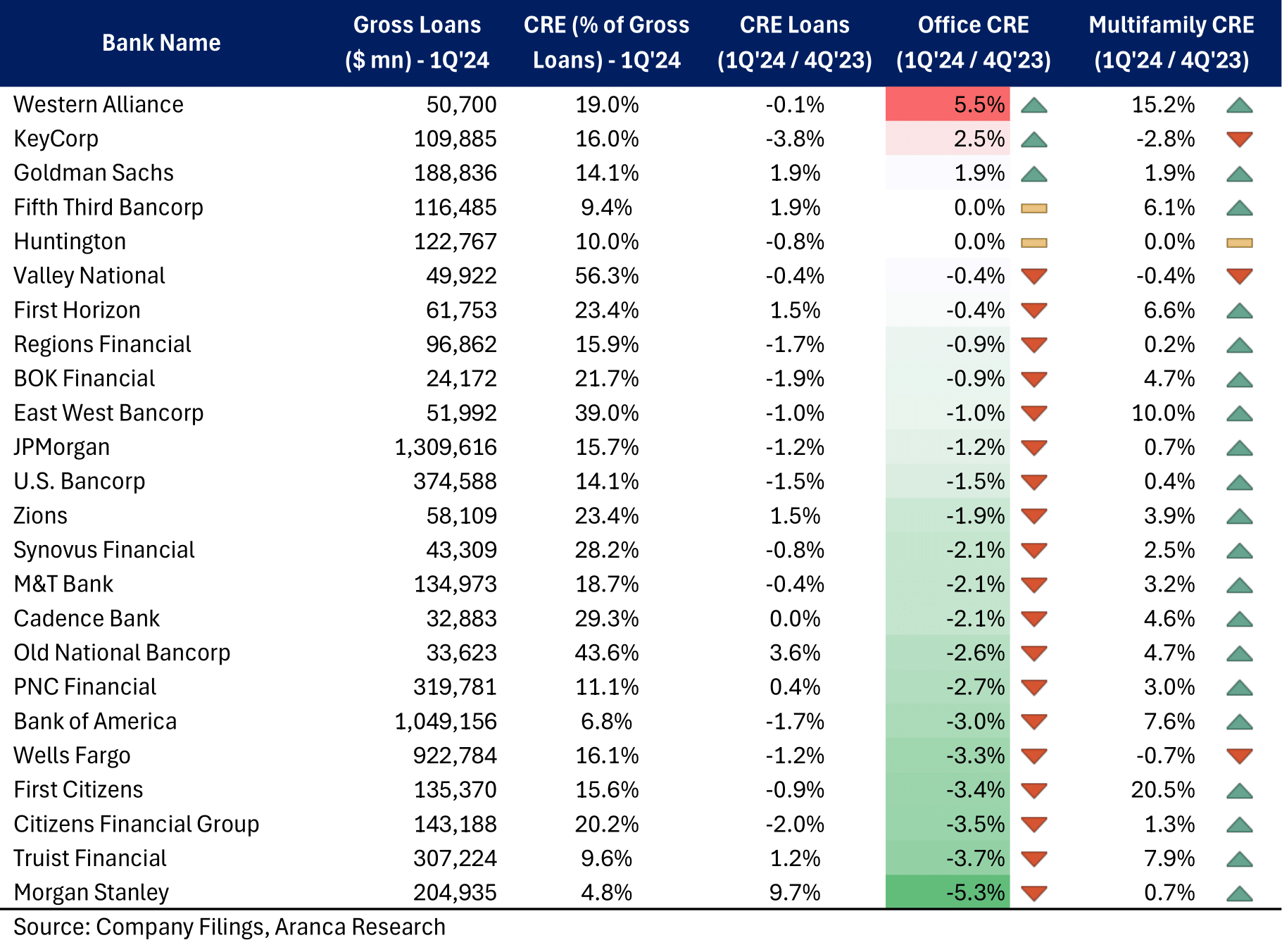

Amid signs of deteriorating fundamentals and rising delinquencies within the office segment, most of the large US banks shifted their portfolio mix from office to multifamily properties, which is relatively resilient due to higher rental income and lower vacancy rates.

As the Federal Reserve remains cautious about rate cuts due to elevated inflation levels, the risk of increasing loan delinquencies is likely to persist for an extended period. Regional banks face greater delinquency risk due to their larger CRE exposure compared to the Big 4 US banks. Moody’s expects defaults on office loans to continue through 2026, driven by expensive refinancing conditions, a decline in net operating income (NOI) from office properties, higher vacancy rates, and uncertainty regarding future hybrid work arrangements. Moreover, Fitch expects delinquencies on office loans used as collateral in CMBS to surpass levels seen during the global financial crisis of 2008.

Reducing exposure to troubled office loans would make banks better positioned to manage risk arising from higher delinquencies on these loans. If demand for office spaces continues to remain subdued and high interest rates persist longer than expected, defaults in the office loan segment could climb to unmanageable levels.