Emerging Alternatives for Lithium-Ion Batteries

Published on 20 Sep, 2024

As our energy storage requirements continue to grow and diversify, researchers and companies are exploring alternatives to address the limitations of Li-ion technology such as thermal runaway, limited energy density and raw material availability. This article discusses the status, challenges and emerging alternatives to Li-ion batteries that may shape the future of energy storage.

Lithium-ion (Li-ion) batteries have revolutionised portable electronics and electric vehicles over the past decades. They are ubiquitous in modern technology, powering smartphones, laptops, electric vehicles and renewable energy storage systems. Their widespread adoption is due to their high energy density, long cycle life and low self-discharge rate. However, as our energy storage requirements continue to grow and diversify, researchers and companies are exploring alternatives to address the limitations of Li-ion technology such as thermal runaway, limited energy density and raw material availability. This article discusses the status, challenges and emerging alternatives to Li-ion batteries that may shape the future of energy storage.

Current Status

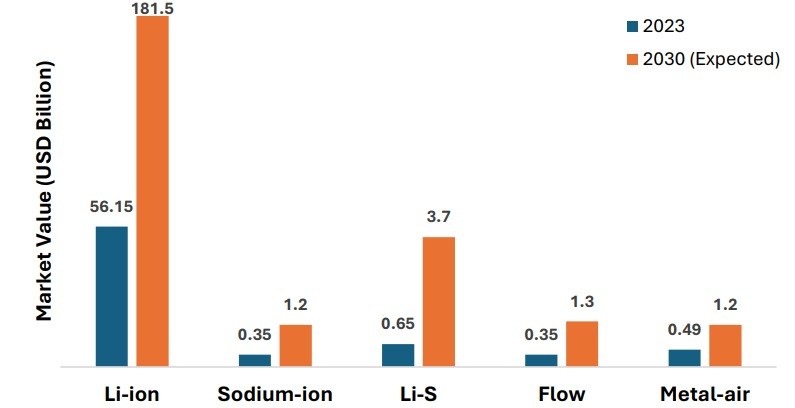

Li-ion batteries enabled the proliferation of portable electronics and is crucial in the transition to clean energy sources. The global Li-ion battery market was valued at $56.12 billion in 2023 and is projected to reach $181.45 billion by 2030, growing at a CAGR of 18.25% from 2024 to 2030 (Ref). Major industry players like Panasonic, LG Chem, Samsung SDI, CATL and Tesla continue to invest in improving energy density, reducing costs and enhancing safety.

Drawbacks of Li-ion Batteries and Solutions:

Despite their popularity and advantages, Li-ion batteries have drawbacks that affect their performance, safety and lifespan. Industry leaders and scientists are actively addressing the following limitations through innovative approaches:

1. Limited Energy Density:

Challenge

The energy density of current Li-ion batteries, while improved, is approaching the theoretical limit of 350-400 Wh/kg, throttling advancements in device runtime and electric vehicle range.

Solution

Researchers are exploring advanced cathode and anode materials to push beyond current energy density limits. Silicon anodes, pioneered by Sila Nanotechnologies and Amprius, could boost energy density by 20-40% over traditional graphite anodes. Additionally, lithium-metal anodes are being investigated, with QuantumScape claiming their solid-state battery design could achieve energy densities of 400 Wh/kg or more. Sodium-ion batteries, developed by CATL, Faradion and Natron Energy, promise lower costs and safer operation, with the market expected to grow to $1.2 billion by 2030 (Ref). Lithium-sulphur batteries, pursued by Lyten and Sion Power, boast an impressive theoretical energy density and could reach a market value of $3.7 billion by 2030 (Ref). Metal-air batteries, by NantEnergy and Phinergy, provide high theoretical energy density and use abundant materials, with the market expected to reach $1.2 billion by 2030 (Ref.) (See figure comparing the market values of different batteries).

Market value of batteries in 2023 and 2030 (expected).

2. Safety Concerns:

Challenge

Li-ion batteries possess serious safety concerns such as thermal runaway risks leading to high-profile incidents like the Samsung Galaxy Note 7 recall in 2016, which cost the company an estimated $5.3 billion.

Solution

To mitigate risks, companies are developing advanced battery management systems (BMS) that use AI and machine learning to predict and prevent thermal runaway. For example, Tesla's BMS continuously monitors thousands of data points to ensure safe operation. Solid-state electrolytes are also being researched as a safer alternative to liquid electrolytes, with Toyota aiming to introduce solid-state batteries in hybrid vehicles by 2025.

3. Raw Material Scarcity:

Challenge

The increasing demand for raw materials has led to price volatility, with lithium prices surging over 400% between 2021 and 2022. Cobalt, another critical component, faces supply chain issues, with over 70% of global production concentrated in the Democratic Republic of Congo.

Solution

To address resource constraints, companies are developing batteries with reduced cobalt content. Panasonic and Tesla have announced plans to produce cobalt-free batteries. Additionally, recycling efforts are ramping up, with companies like Li-Cycle and Redwood Materials aiming to recover up to 95% of critical materials from spent batteries. Researchers are also exploring abundant alternatives, such as sodium-ion batteries, with CATL announcing mass production plans. Flow batteries, with key players like Sumitomo Electric and ESS Inc., offer scalable capacity and long cycle life, with the market projected to hit $1.3 billion by 2030 (Ref).

4. Environmental Impact:

Challenge

The environmental impact is substantial. In some regions, lithium extraction consume up to 500,000 gallons of water per metric ton of lithium produced (Ref).

Solution

The industry is working to reduce the environmental footprint of battery production. For instance, Northvolt in Sweden aims to produce batteries using 100% renewable energy. Direct lithium extraction (DLE) technologies are being developed to reduce water consumption and land use in lithium mining. Companies like Lilac Solutions and Energy Source Minerals are pioneering these sustainable extraction methods.

5. Charging Speed:

Challenge

Charging speeds remain a challenge, with most electric vehicles requiring thirty minutes to an hour for an 80% charge using fast charging, far longer than refuelling a conventional vehicle.

Solution

Fast-charging technologies are rapidly evolving. Tesla's V3 Superchargers can now deliver peak charging rates of 250 kW, allowing some models to gain up to 75 miles of range in five minutes (Ref). Researchers at Penn State University have demonstrated a battery capable of charging to 70% capacity in just ten minutes (Ref). Extreme fast charging (XFC) is also being developed, with StoreDot aiming to produce batteries that can charge in as little as five minutes.

6. Performance In Extreme Temperatures:

Challenge

Temperature sensitivity further complicates matters, with Li-ion batteries losing up to 40% of their capacity at -20°C (-4°F) and experiencing accelerated degradation at elevated temperatures, potentially reducing their lifespan by 50% when regularly exposed to temperatures above 40°C (104°F).

Solution

To improve temperature performance, companies are developing new electrolyte formulations and battery thermal management systems. For cold weather, Tesla has introduced a feature that preheats the battery using electricity from the grid while the car is still plugged in. For high temperatures, advanced cooling systems like immersion cooling are being explored. XING Mobility has developed a battery system that immerses cells in 3M's Novec cooling fluid, allowing for better performance in extreme conditions.

Currently, Li-ion battery costs are estimated at $137/kWh. Alternatives such as sodium-ion are potentially 30-50% cheaper, while solid-state batteries are more expensive. As these new battery types mature, they are likely to find specific niches within the energy storage ecosystem, coexisting rather than completely replacing Li-ion batteries.

Conclusion

The future of energy storage will involve a diverse mix of technology, each optimised for specific applications. Solid-state batteries are promising for electric vehicles and consumer electronics, attracting significant investment from automakers and battery companies. Flow batteries and advanced sodium-ion technologies could compete for grid-scale storage, especially for long-duration applications in renewable energy integration. Lithium-sulphur and metal-air batteries might excel in high energy density areas like aerospace if cycle life and rechargeability improve. Hydrogen fuel cells are poised to impact heavy-duty transport, where battery weight and charging times are crucial. Continued research, supportive policies, and infrastructure will be key to commercialising these technologies, driving sustainable energy and transportation while addressing global energy demands.