Decoding Alternative Assets/Portfolio Valuation for Financial Reporting (ASC 820)

Published on 27 May, 2024

Valuation of companies for financial reporting has always been vexing. Valuation methodologies adopted for investment analysis can drastically vary from those deployed for reporting the investments at fair value for financial reporting (ASC 820). While the fundamental approaches are still preferred, Asset Manager in PE/VC firms have been using the implied post-money valuation derived from the latest preferred financing to assess their stake value. This method involves multiplying the company's post-money valuation by their percentage of fully diluted ownership. While it represents one of the possible outcomes (successful exit), it is important to acknowledge other scenarios as well that might enforce the use of other economic rights held by such preferred instruments. In such cases, the above-mentioned method may present certain limitations, as elaborated in the article.

PE and VC firms employ diverse methodologies for assessing a company's equity value, including the income, market, and cost approaches. An investor evaluates the applicability of different valuation methodologies based on several factors, including, but not limited to, the company’s development stage, significant milestones in its business plan, its operating history, the industry in which it operates, quality of relevant data for each approach, etc.

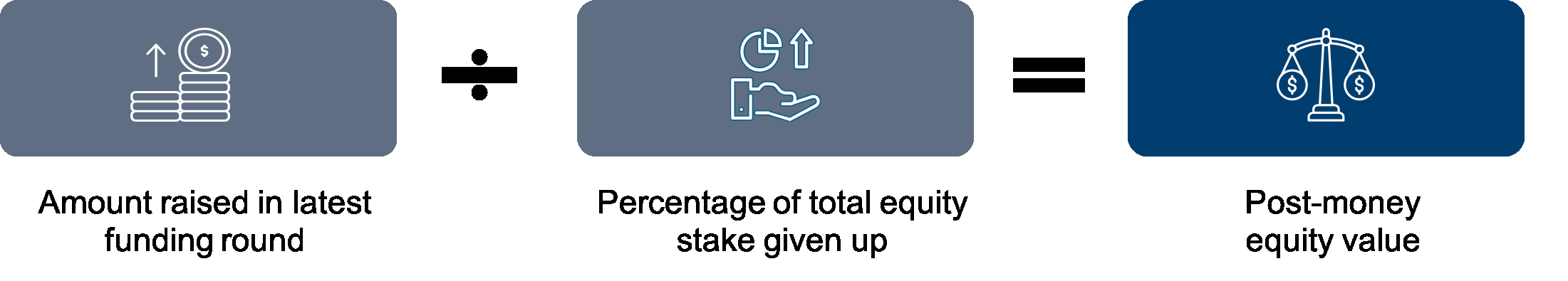

Implied post-money valuation based on the latest preferred financing is an alternative market method for determining the equity value of a company for financial reporting purposes (ASC 820).

Implied Post-Money Valuation at Latest Preferred Financing

Post-money valuation plays a crucial role in finance, providing vital perspectives into a company's value right after securing new funding. The post-money equity value of a company can be calculated as below:

For example, XYZ Company recently completed its Series C funding round, securing $10 million in investment. As a per the agreement, investors acquired 25% stake in the company, as seen in the cap table below:

Class of stock |

No. of shares |

Issue Price/ Share |

% Ownership (diluted) |

|---|---|---|---|

Series A Preferred Shares |

1,500,000 |

$1.0 |

18.8% |

Series B Preferred Shares |

1,500,000 |

$2.0 |

18.8% |

Series C Preferred Shares |

2,000,000 |

$5.0 |

25.0% |

Common Shares |

2,000,000 |

25.0% |

|

Option @ $0.2 |

1,000,000 |

$0.2 |

12.5% |

Total |

8,000,000 |

100.0% |

This implies that the value of 25% ownership is $10 million. By extrapolating this percentage, we can determine the company’s total value to be $40 million ($10 million divided by 25%). Therefore, the post-money valuation of XYZ company stands at $40 million. The pre-money valuation, accordingly, stands at $30 million. This implies that all the alternative assets are valued at the same price (8,000,000 shares * $5) as that of the most recent funding round.

Fund managers commonly use the implied post-money valuation from the latest funding round to report the fair market value of their stake. This calculation involves multiplying the post-money valuation of the company by their percentage of fully diluted ownership.

Limitations of Post-Money Valuation Method

The implied post-money valuation method assumes all classes of equity (preferred and common stock) are equally valuable. However, each security comes with unique rights and preferences. These rights and preferences can be economic or non-economic.

Economic rights |

Control rights |

|---|---|

a. Preferred dividends |

a. Voting rights |

b. Liquidation preferences |

b. Protective provisions and veto rights |

c. Participation rights |

c. Board composition |

d. Conversion rights |

d. Drag-along rights |

e. Antidilution rights |

e. Management rights/Information Rights |

f. First refusal rights and co-sale rights |

For instance, referring to the previous example, the company has an equity value of $40 million with 8 million shares outstanding. Going by basic mathematics, each share seems worth $5 ($40 million / 8 million), but this is not really the case in almost all companies. This is primarily because preferred shareholders may have a liquidation preference (LP) that gives them priority economic rights over other shareholders. With an LP right, common shareholders would see any return only and only if preferred shareholders receive their LP.

Similarly, fund managers holding Series B shares and pegging their value to the latest round of funding i.e., Series C at $5 per share in the example above may not reflect its fair value. This is because it overlooks the possibility that Series C preferred shares may entail preferential rights compared to Series B shares such as seniority in LP, different conversion terms, and participation rights. Thus, it is not fair to assume both securities have similar value.

While economic rights directly affect the value of the alternative, non-economic rights such as control rights help influence board decisions such as in the case of preferred shareholders with substantial stake. In contrast, minority common shareholders typically have minimal influence over company matters due to their limited stake. Considering the differential claims held by different alternatives on a company’s cash flows, it would be detrimental to assume all assets (shares) have the same value.

The fundamental concept of allocating equity value among various classes of securities after considering their specific rights and preferences is extremely important. This can be captured by the Options Pricing Model, which relies on the Black-Scholes_Merton model.

Implications of Options Pricing Model

If the company’s capital structure involves multiple assets (preferred shares), a waterfall analysis is ideal to showcase how holders of these alternative assets will be rewarded at the time of liquidation. The rights and preferences of outstanding securities determine various “breakpoints” for the valuation used in the waterfall analysis. Essentially, breakpoints represent different equity values of the company when different classes of shares start deriving value. For instance, until the company’s equity value is $10 million or below, only Series C preferred shareholders would get any value due to their LP over other classes of securities. Alternately, a Series C shareholder would consider converting to common stock only when the equity value surpasses $39.8 million.

Waterfall Analysis |

Participating Class |

Participating Shares (#) |

Strike Point ($) |

|---|---|---|---|

Enterprise Value is zero |

None |

0 |

|

Liquidation Preference – Series C |

Series C |

2,000,000 |

10,000,000 |

Liquidation Preference – Series A & Series B |

Series A & Series B |

1,500,000 |

14,500,000 |

Exercise of Options @$0.2 |

Common Stock |

2,000,000 |

14,900,000 |

Conversion of Series A |

Above + Options @$0.2 |

3,000,000 |

17,300,000 |

Conversion of Series B |

Above + Series A |

4,500,000 |

21,800,000 |

Conversion of Series C |

Above + Series B |

6,000,000 |

39,800,000 |

Thereafter |

All Classes |

8,000,000 |

The method considers common stock as a call option on the equity value, as the common stock only receives returns if the firm’s value exceeds the LP of the preferred series. OPM accurately captures the intrinsic and speculative value associated with holding the option. Under OPM, breakpoints (future events: participation, conversion) act as the strike price, while the company’s equity value as of today is the spot price. The option value derived for each breakpoint is then allocated among the various equity classes participating in that breakpoint to arrive at the total value attributable to each security.

Conclusion

While post-money valuation is generally used to develop an indication of equity value along with other valuation methods, it may not be used explicitly disregarding the rights associated with the rights. When determining the fair value of share classes, allocating the equity value using OPM becomes essential to account for the different rights and preferences. Given its objectivity, a Fair market valuation using an OPM and unique strike points in line with the rights is usually the most reliable indicator to fair value of alternative assets.