The IT M&A Deal Trends Q2,2025

published on Oct 03, 2025 Published by Aranca

Announcements, Coverage, Press Kit and more

For over 2000 companies, from the hottest startups to the Fortune 500, Aranca is the preferred and trusted custom research, analytics and advisory partner.

Meet our Leadership team

Every month we introduce you to one of our experts along with their insights on latest news.

Nikhil Salvi is a manager in Investment Research and Analytics practice at Aranca. He focuses on capital market research and macroeconomic research across major developed economies as well as emerging economies. He leads teams of analysts providing research and analytics to leading investment firms in Middle East, Africa and Asia. Nikhil regularly communicates with media on behalf of Aranca to provide opinions on capital market and macroeconomic developments, and has regularly contributed to thought pieces published on Aranca website.

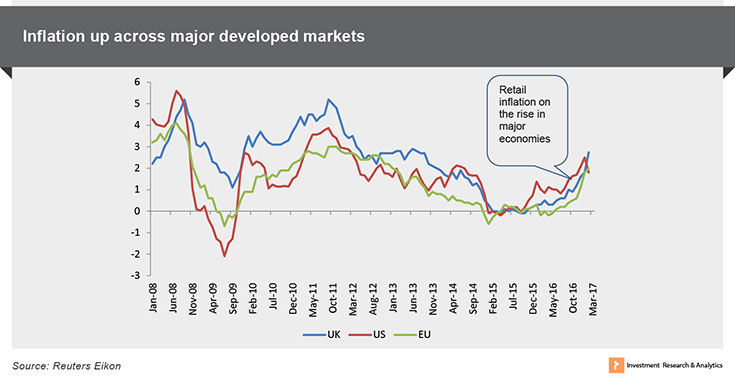

The economies of both US and Europe appear to be gaining strength. The US economy started to show positive signals in terms of inflation, employment and wage growth in 2016 itself and appears to extend the momentum in terms of real estate and consumer sector demand in 2017. European economies have shown improvement in both sentiment indicators and economic indicators, especially inflation, early on in 2017, and appear to continue the upward trajectory for the year.

Major central banks have also revised their growth expectations upwards for the year. Bank of England (BoE) has increased UK’s growth forecast for 2017 to 2.0 per cent from November’s forecast of 1.4 per cent, and also expects UK inflation to exceed its targeted 2 per cent mark in 2017 to touch 2.7 per cent by the end of the year. Bank of Japan (BoJ) too has upgraded its growth forecast for the Japanese economy, by raising the estimate for current fiscal to 1.4 per cent from 1.0 per cent projected in October. Further, for fiscal 2017, BoJ has raised growth forecast to 1.5 per cent from 1.1 per cent and for fiscal 2018 to 1.1 per cent from 0.9 per cent projected earlier in October.

The growth momentum in economies has provided the foundation for the record run of equities across developed markets. Having digested the shocks of Brexit and Trump win, the equity markets appear to take cues from corporate earnings growth, likely return to normal monetary policy by US Federal Reserve, and the reflation trade. The momentum has also rubbed off on emerging markets, which have followed the positive sentiment with recent gains. The fixed income market, however, appears more ambivalent, with select sovereign instruments such as German 2-year bonds witnessing strong demand as compared to other European nations’ instruments, leading to widening of spreads.

The Trump administration has so far promised substantial tax cuts, spending on infrastructure, defence and easing of regulations on banking industry. These have augured better prospects for companies related to the specific sectors and overall corporate environment in general. Some of the more debatable proposals – imposition of tariffs on goods from countries that compete with domestic products, a more stringent immigration policy, increased spending on defence and budget cuts in several departments – would also have their effects on the economy and will need to be studied in more detail as they are rolled out. As of March 2017, any concrete actions are not yet visible, as the administration grapples with challenges in getting key bills passed, in spite of Republican majority in both houses.

However, the broad principles behind the various policy proposals and the thought process ought to be understood early on. The Trump administration appears to be designing economic policies in line with the concept of ‘Economic Nationalism’, as articulated by Special Counsel to the President, Steve Bannon, during his address to the Conservative Political Action Conference (CPAC) summit in February 2017. The broad strokes under this concept include preference for saving jobs to Americans, protecting domestic industries and aiming to gain an advantageous position for American businesses. Already, President Trump appears to have persuaded several leading US companies to cancel moving part of their production outside US.

The policies, if implemented in line with the above concept, could lead to trade conflicts, imposition of tariffs and reciprocal action by other nations, volatility in USD, shortage of labour in more labour-intensive sectors such as agriculture, especially in states along southern border of US. Import-dependent sectors could be negatively affected under such policies. At the same time, sectors such as defence could gain from additional government spending and localised production.

The emerging markets appear to be dealing with their own home-grown challenges, rather than global risks. The strength of US dollar is pushing emerging market currencies weaker and the onset of ‘lift-off’ by US Federal Reserve with increase in interest rates, has led to outflows from emerging markets. However, growth prospects in major emerging market countries appear broadly positive.

Among emerging markets, the Indian economy appears to have taken the effect of demonetisation in stride and moved on, as can be deduced from the 7 per cent GDP growth rate for December 2016 quarter. The PMI index numbers have also showed improvement over previous months, with the Nikkei India Composite PMI Output Index rising to 52.3 in March 2017 over 50.7 for February. However, the bad loan recognition by the banking sector, which has led to increase in share of non-performing assets (NPAs) has affected profitability of banking sector. Further, credit growth has slowed down considerably, indicating weak appetite for borrowing.

The economies in the Middle East are in a state of flux as well. The volatility in oil prices continues to impact the economy, government spending and is driving major decisions – from cuts in productions to announcement of new taxes. While the foreign currency reserves of major economies such as Saudi Arabia have reduced to fund fiscal deficits, the region has also witnessed maiden bond issuances in the international markets. Saudi Arabia and Qatar raised US$ 17.5 billion and US$ 9 billion respectively in 2016. Kuwait has followed suit with the third largest international bond issuance in the history of the GCC region of US$ 8 billion in March 2017. While the bonds may be rightly timed (in wake of rising interest rates due to US Fed policy), they provide limited support to fiscal imbalances. The governments have realised the need for long term fiscal discipline, which has led to announcement of various measures ranging from fuel price hikes to new taxes.

published on Oct 03, 2025 Published by Aranca

published on Sep 29, 2025 Published by Exchange4Media

published on Sep 15, 2025 Published by Storyboard18

published on Sep 12, 2025 Published by Business World

published on Oct 13, 2025

published on Aug 12, 2025

published on Aug 08, 2025

published on May 12, 2023

published on May 06, 2020

(Your Primary Media Contact)

T: +91 22 3937 9999

E: shreya.das@aranca.com

Over 400+ analysts across 5 research domains covering over 100 sectors, 90+ countries share insights and opinions on a wide range of topics.

© , Aranca. All rights reserved.